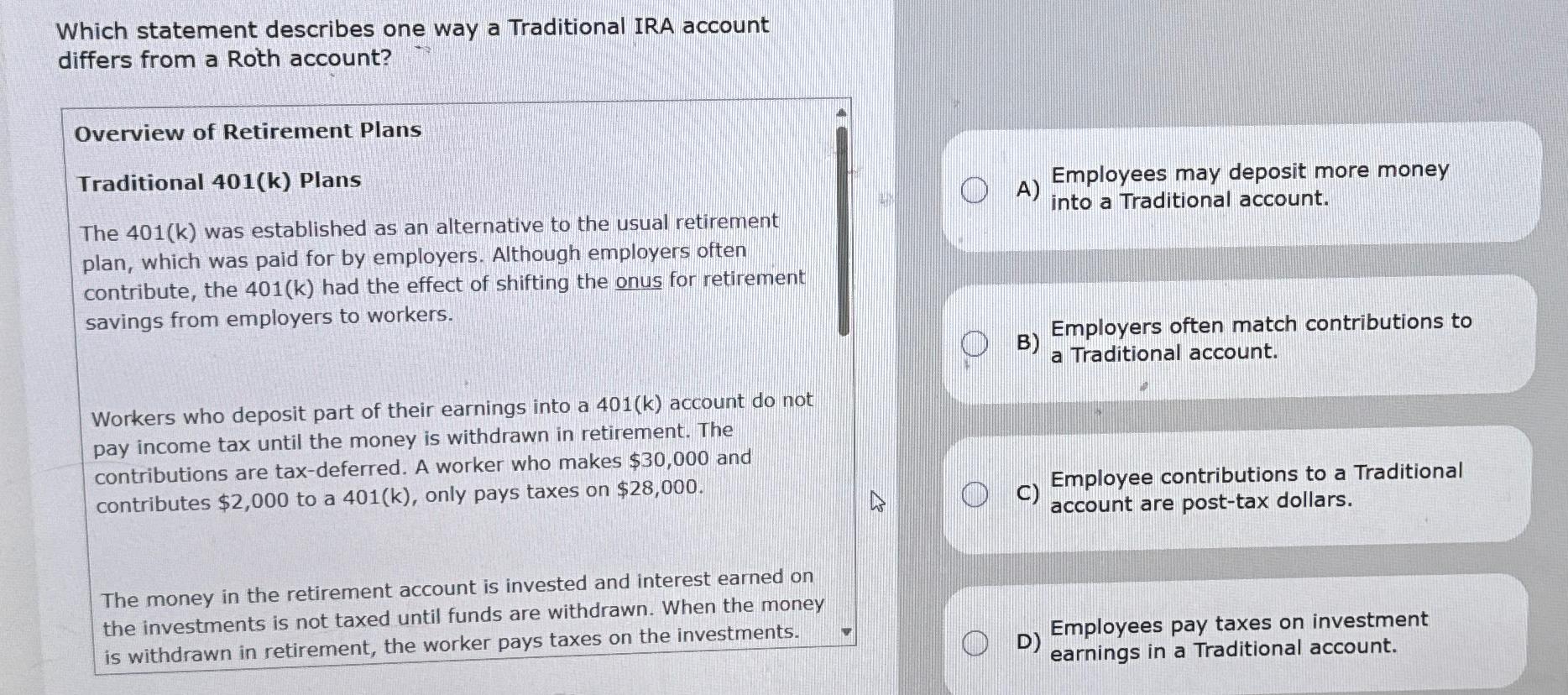

Question: Which statement describes one way a Traditional IRA account differs from a Roth account? Overview of Retirement Plans Traditional 401(k) Plans The 401(k) was established

Which statement describes one way a Traditional IRA account differs from a Roth account?\ Overview of Retirement Plans\ Traditional 401(k) Plans\ The

401(k)was established as an alternative to the usual retirement plan, which was paid for by employers. Although employers often contribute, the

401(k)had the effect of shifting the onus for retirement savings from employers to workers.\ A) Employees may deposit more money into a Traditional account.\ Workers who deposit part of their earnings into a

401(k)account do not pay income tax until the money is withdrawn in retirement. The contributions are tax-deferred. A worker who makes

$30,000and contributes

$2,000to a

401(k), only pays taxes on

$28,000.\ B) Employers often match contributions to a Traditional account.\ C) Employee contributions to a Traditional account are post-tax dollars.\ The money in the retirement account is invested and interest earned on the investments is not taxed until funds are withdrawn. When the money is withdrawn in retirement, the worker pays taxes on the investments.\ D) Employees pay taxes on investment earnings in a Traditional account.

Which statement describes one way a Traditional IRA account differs from a Roth account? Overview of Retirement Plans Traditional 401(k) Plans The 401(k) was established as an alternative to the usual retirement plan, which was paid for by employers. Although employers often contribute, the 401(k) had the effect of shifting the onus for retirement savings from employers to workers. Workers who deposit part of their earnings into a 401(k) account do not pay income tax until the money is withdrawn in retirement. The contributions are tax-deferred. A worker who makes $30,000 and contributes $2,000 to a 401(k), only pays taxes on $28,000. The money in the retirement account is invested and interest earned on the investments is not taxed until funds are withdrawn. When the money is withdrawn in retirement, the worker pays taxes on the investments. A) Employees may deposit more money into a Traditional account. B) Employers often match contributions to a Traditional account. C) Employee contributions to a Traditional account are post-tax dollars. D) Employees pay taxes on investment earnings in a Traditional account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts