Question: Which statement is true about claiming the Section 1 9 9 A deduction on a tax return? An individual takes the 1 9 9 A

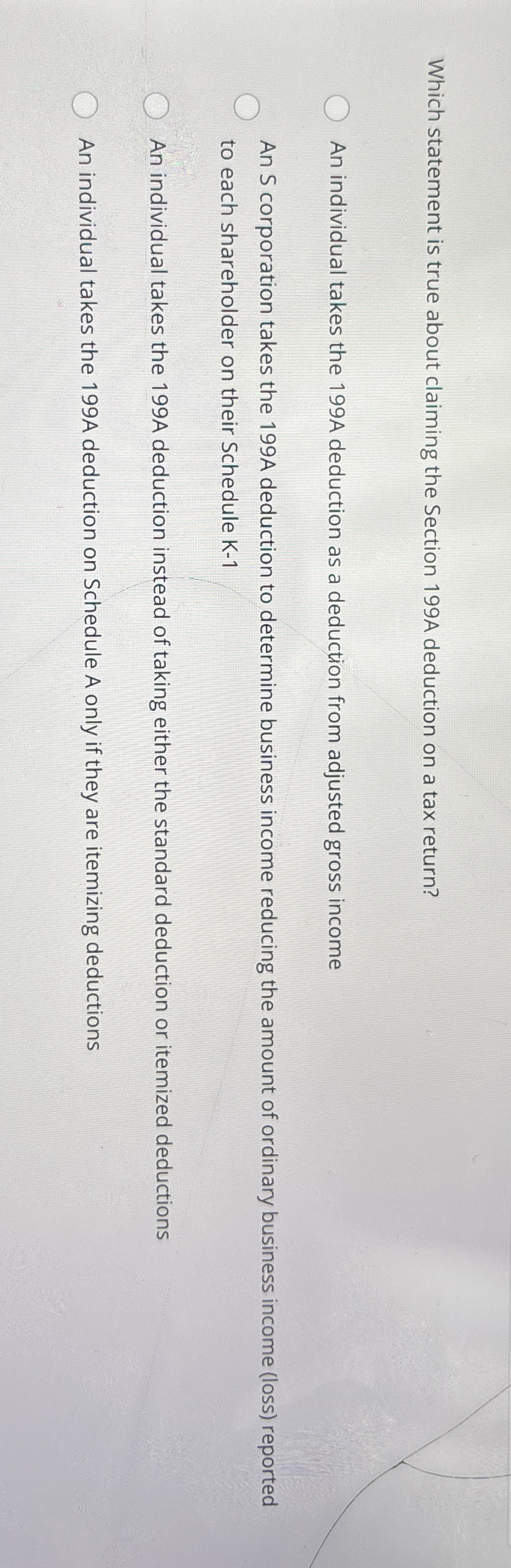

Which statement is true about claiming the Section A deduction on a tax return?

An individual takes the A deduction as a deduction from adjusted gross income

An S corporation takes the A deduction to determine business income reducing the amount of ordinary business income loss reported

to each shareholder on their Schedule K

An individual takes the A deduction instead of taking either the standard deduction or itemized deductions

An individual takes the A deduction on Schedule A only if they are itemizing deductions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock