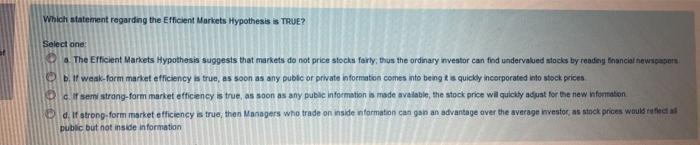

Question: Which statement regarding the Efficient Markets Hypothesis is TRUE? Select one The Efficient Markets Hypothesis suggests that markets do not price stocks fairly, thus the

Which statement regarding the Efficient Markets Hypothesis is TRUE? Select one The Efficient Markets Hypothesis suggests that markets do not price stocks fairly, thus the ordinary investor can find undervalued stocks by reading financial news b. If weak-form market efficiency is true, as soon as any public or private information comes into being is quickly incorporated into stock prices c. If sem strong-form market efficiency is true, as soon as any public information is made available, the stock price will quickly adjust for the new nformation d. If strong form market efficiency is true, then Managers who trade on inside information can gain an advantage over the average investoras stock prices would reflect public but not inside information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts