Question: Which statement regarding the Efficient Markets Hypothesis is TRUE? Select one: O a The Efficient Markets Hypothesis suggests that markets do not price stocks fairly:

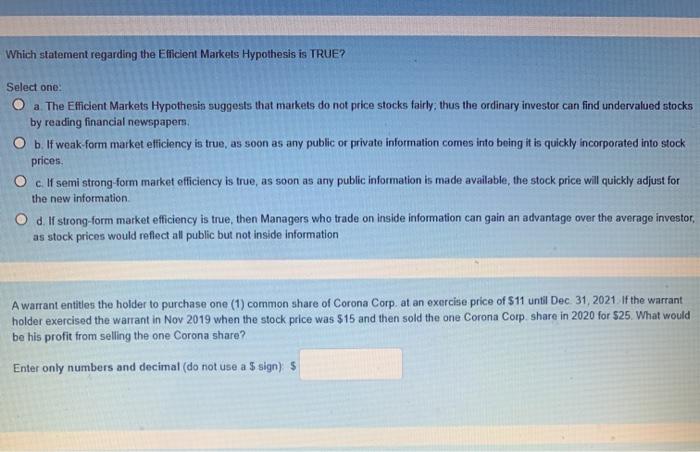

Which statement regarding the Efficient Markets Hypothesis is TRUE? Select one: O a The Efficient Markets Hypothesis suggests that markets do not price stocks fairly: thus the ordinary investor can find undervalued stocks by reading financial newspapers. O b. If weak-form market efficiency is true, as soon as any public or private information comes into being it is quickly incorporated into stock prices O cIf semi strong form market officiency is true, as soon as any public information is made available, the stock price will quickly adjust for the new information O d. If strong-form market efficiency is true then Managers who trade on inside information can gain an advantage over the average investor, as stock prices would reflect all public but not inside information A warrant entitles the holder to purchase one (1) common share of Corona Corp. at an exercise price of $11 until Dec 31, 2021. If the warrant holder exercised the warrant in Nov 2019 when the stock price was $15 and then sold the one Corona Corp. share in 2020 for $25. What would be his profit from selling the one Corona share? Enter only numbers and decimal (do not use a 5 sign) s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts