Question: Which statements about normal distributions are correct? The standard deviation of a portfolio of assets is always equal to the sum of the individual assets'

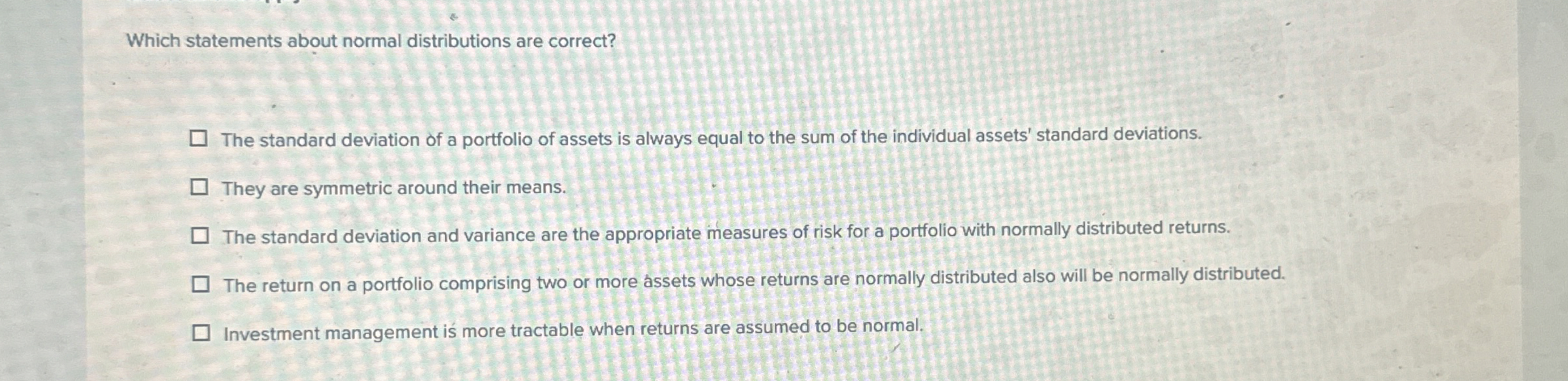

Which statements about normal distributions are correct?

The standard deviation of a portfolio of assets is always equal to the sum of the individual assets' standard deviations.

They are symmetric around their means.

The standard deviation and variance are the appropriate measures of risk for a portfolio with normally distributed returns.

The return on a portfolio comprising two or more assets whose returns are normally distributed also will be normally distributed.

Investment management is more tractable when returns are assumed to be normal.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock