Question: Which statements about the equivalent taxable yield are correct? Define t as the marginal tax rate, r m u n i as the rate on

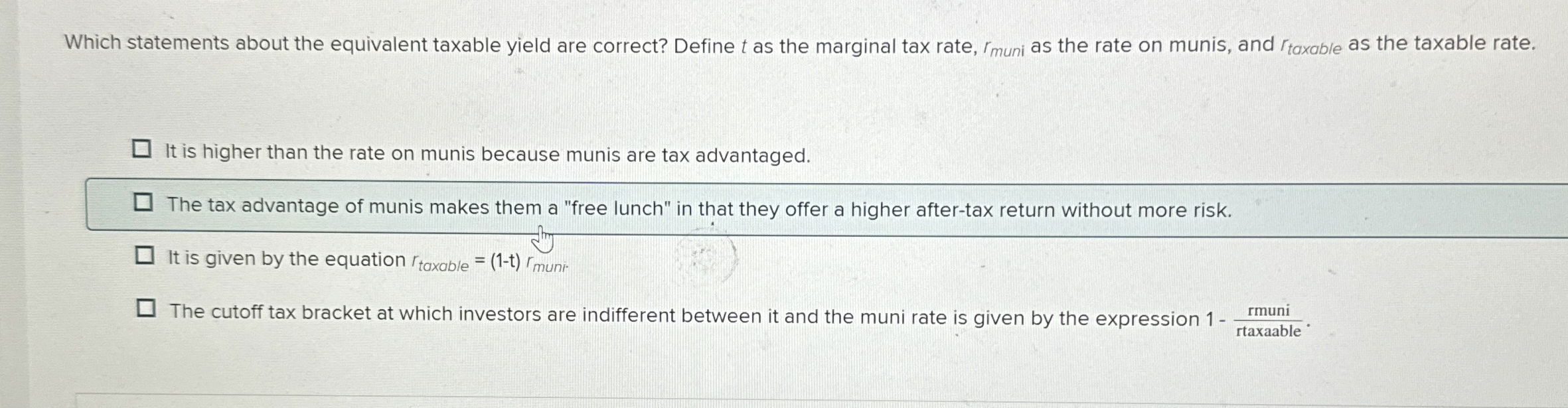

Which statements about the equivalent taxable yield are correct? Define as the marginal tax rate, as the rate on munis, and as the taxable rate.

It is higher than the rate on munis because munis are tax advantaged.

The tax advantage of munis makes them a "free lunch" in that they offer a higher aftertax return without more risk.

It is given by the equation

The cutoff tax bracket at which investors are indifferent between it and the muni rate is given by the expression

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock