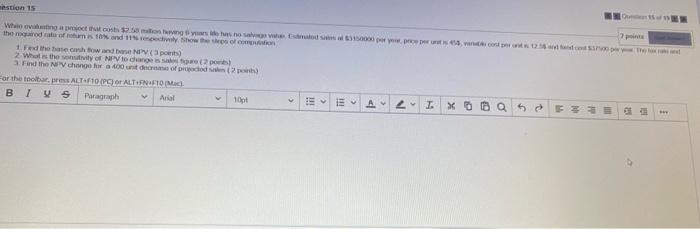

Question: While evaluating a project that costs $2.58 million having 6 years life has no salvage value . Estimated sales at $3,150000 per year price per

estion 15 Whiting action gas por the regardinston 11 rence show the deserto 1. Fed the tech town NV 3 ports) 2 What the son of NFVouga (2) Find the change for a 400 unit of 2 For the food press ALT F10 (P) OF ALTENFOMC) B TVs Paragraph 1001 E A 2TX to a F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts