Question: ((Whithout exel)) Problem 8-3 Given the previous information form problem 8-1. Assume that the correlation coefficient between stocks X and Y is +1.0. Choose the

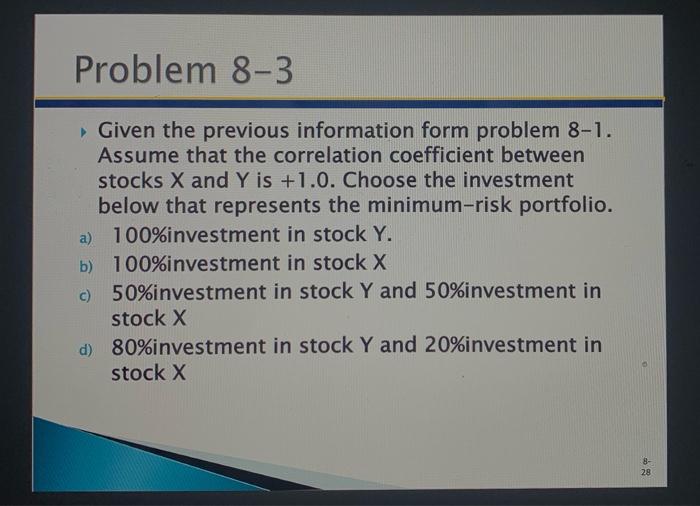

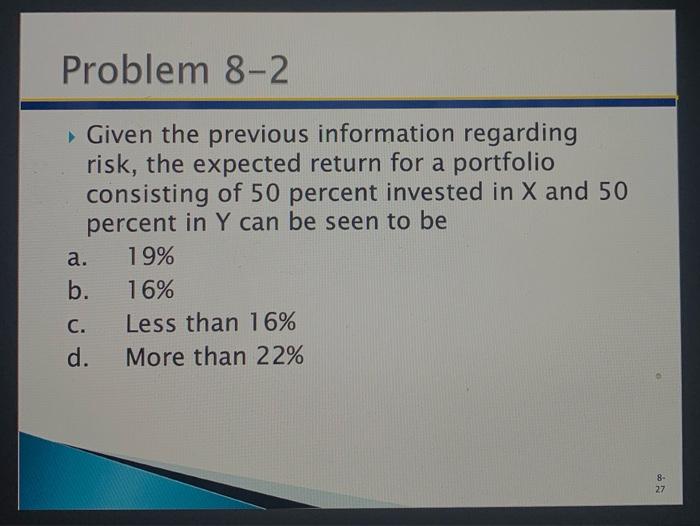

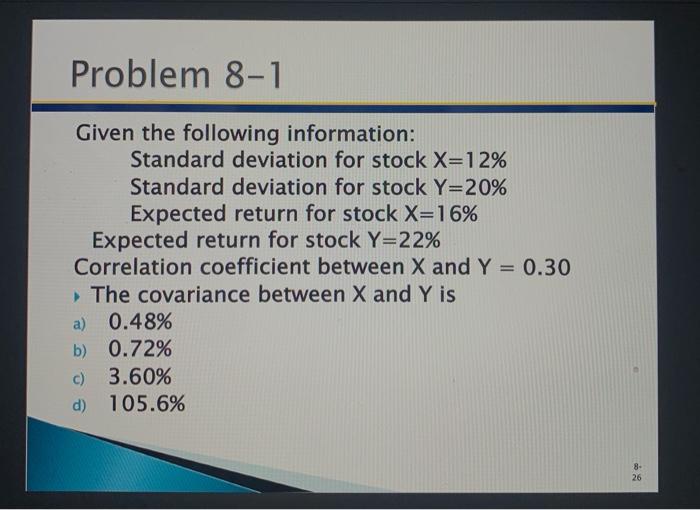

Problem 8-3 Given the previous information form problem 8-1. Assume that the correlation coefficient between stocks X and Y is +1.0. Choose the investment below that represents the minimum-risk portfolio. 100%investment in stock Y. b) 100%investment in stock X c) 50%investment in stock Y and 50%investment in stock X d) 80%investment in stock Y and 20%investment in stock X 8- 28 Problem 8-2 Given the previous information regarding risk, the expected return for a portfolio consisting of 50 percent invested in X and 50 percent in Y can be seen to be 19% b. 16% Less than 16% d. More than 22% a. C. 8- 27 Problem 8-1 Given the following information: Standard deviation for stock X=12% Standard deviation for stock Y=20% Expected return for stock X=16% Expected return for stock Y=22% Correlation coefficient between X and Y = 0.30 The covariance between X and Y is a) 0.48% b) 0.72% c) 3.60% d) 105.6% 8- 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts