Question: Who can solve this question please? QUESTION 3. Evaluate the following investment project according to the Net Present Value and the IRR Criteria and propose

Who can solve this question please?

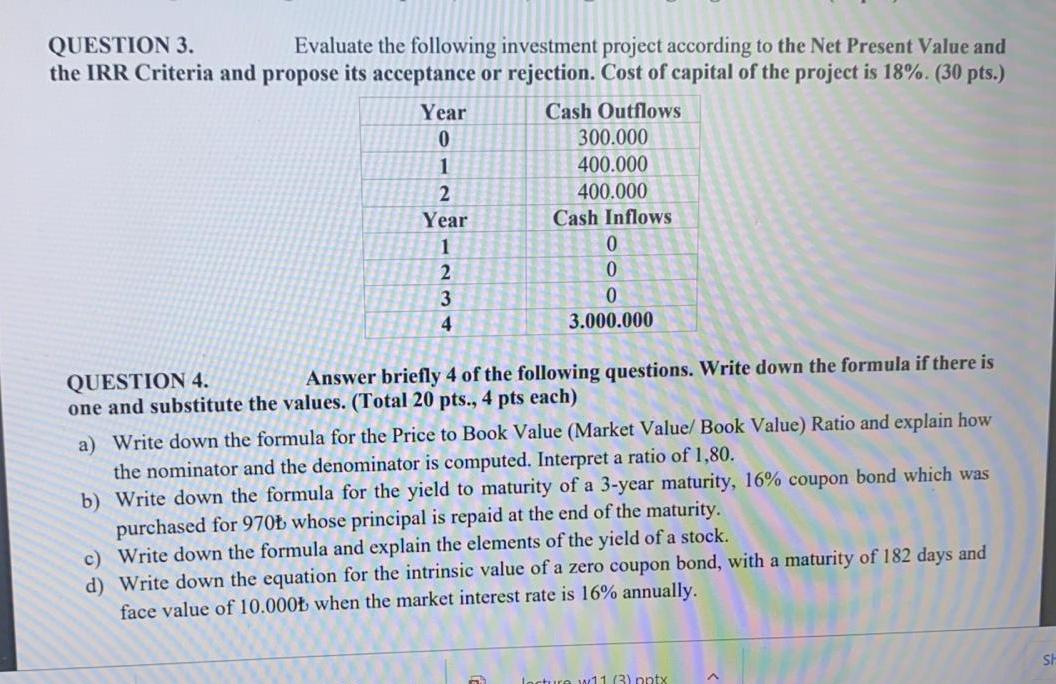

QUESTION 3. Evaluate the following investment project according to the Net Present Value and the IRR Criteria and propose its acceptance or rejection. Cost of capital of the project is 18%. (30 pts.) Year Cash Outflows 0 300.000 1 400.000 2 400.000 Year Cash Inflows 1 0 2 0 3 0 4 3.000.000 QUESTION 4. Answer briefly 4 of the following questions. Write down the formula if there is one and substitute the values. (Total 20 pts., 4 pts each) a) Write down the formula for the Price to Book Value (Market Value/ Book Value) Ratio and explain how the nominator and the denominator is computed. Interpret a ratio of 1,80. b) Write down the formula for the yield to maturity of a 3-year maturity, 16% coupon bond which was purchased for 970 whose principal is repaid at the end of the maturity. c) Write down the formula and explain the elements of the yield of a stock. d) Write down the equation for the intrinsic value of a zero coupon bond, with a maturity of 182 days and face value of 10.000+ when the market interest rate is 16% annually. SH Lecture 11 (3) nptx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts