Question: 2) A manufacturing company uses FIFO (First In First Out) method of valuing its inventory and issues. Its products are normally sold in the

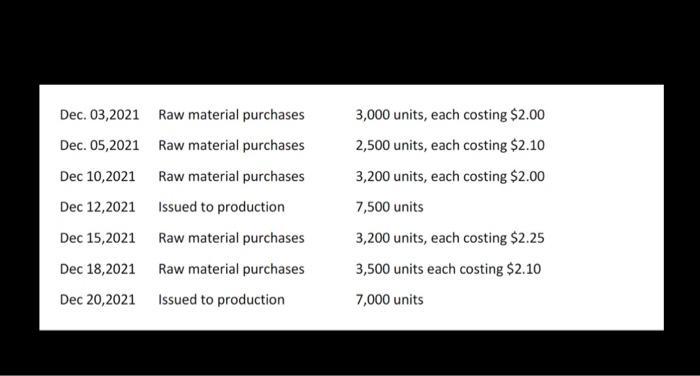

2) A manufacturing company uses FIFO (First In First Out) method of valuing its inventory and issues. Its products are normally sold in the market during Christmas. To meet the market demand, the company purchased raw materials in many lots and issued to production. Below transactions were given for December 2021. You are required to calculate the value of closing stock at the end of December 2021. Dec. 03,2021 Dec. 05,2021 Dec 10,2021 Dec 12,2021 Dec 15,2021 Dec 18,2021 Dec 20,2021 Raw material purchases Raw material purchases Raw material purchases Issued to production Raw material purchases Raw material purchases Issued to production 3,000 units, each costing $2.00 2,500 units, each costing $2.10 3,200 units, each costing $2.00 7,500 units 3,200 units, each costing $2.25 3,500 units each costing $2.10 7,000 units

Step by Step Solution

There are 3 Steps involved in it

SOLUTION STEP 1 Calculation of value of closing stock of raw materials at the end of ... View full answer

Get step-by-step solutions from verified subject matter experts