Question: Why do companies issue convertible bonds? What is the value of the embedded call option on $1000 face value of bonds? 1. Consider the MSFT

- Why do companies issue convertible bonds?

- What is the value of the embedded call option on $1000 face value of bonds?

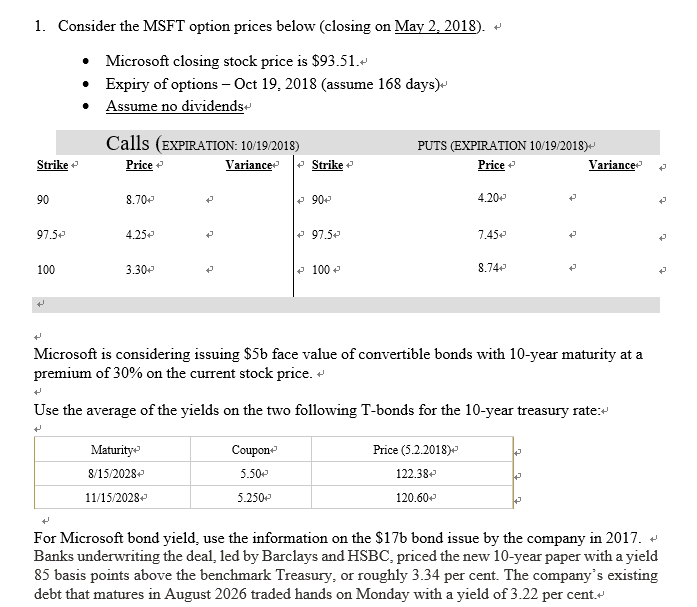

1. Consider the MSFT option prices below (closing on May 2. 2018). + Microsoft closing stock price is $93.51. Expiry of options- Oct 19, 2018 (assume 168 days) Assume no dividends Calls (EXPIRATION: 10/19/2018) PUTS (EXPIRATION 10/19/2018)- VarianceStrike Strikeo Price Price Variance 8.70 4.20 90 90 4.25p 97.5 7.45 97.5a 8.74 3.30 100 100 Microsoft is considering issuing $5b face value of convertible bonds with 10-year maturity at a premium of 30% on the current stock price. +' Use the average of the yields on the two following T-bonds for the 10-year treasury rate:* Maturity Coupon' Price (5.2.2018)' 5.50 122.38 8/15/2028 11/15/2028 5.250 120.60 For Microsoft bond yield, use the information on the S17b bond issue by the company in 2017. ' Banks underwriting the deal, led by Barclays and HSBC, priced the new 10-year paper with a yield 85 basis points above the benchmark Treasury, or roughly 3.34 per cent. The company's existing debt that matures in August 2026 traded hands on Monday with a yield of 3.22 per cent. 1. Consider the MSFT option prices below (closing on May 2. 2018). + Microsoft closing stock price is $93.51. Expiry of options- Oct 19, 2018 (assume 168 days) Assume no dividends Calls (EXPIRATION: 10/19/2018) PUTS (EXPIRATION 10/19/2018)- VarianceStrike Strikeo Price Price Variance 8.70 4.20 90 90 4.25p 97.5 7.45 97.5a 8.74 3.30 100 100 Microsoft is considering issuing $5b face value of convertible bonds with 10-year maturity at a premium of 30% on the current stock price. +' Use the average of the yields on the two following T-bonds for the 10-year treasury rate:* Maturity Coupon' Price (5.2.2018)' 5.50 122.38 8/15/2028 11/15/2028 5.250 120.60 For Microsoft bond yield, use the information on the S17b bond issue by the company in 2017. ' Banks underwriting the deal, led by Barclays and HSBC, priced the new 10-year paper with a yield 85 basis points above the benchmark Treasury, or roughly 3.34 per cent. The company's existing debt that matures in August 2026 traded hands on Monday with a yield of 3.22 per cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts