Question: please help should be done in excel FINC 3380 Homework 6 Seungho Baek Due: Tuesday, May 05 2020, 6:29 P.M. For this homework assignment, you

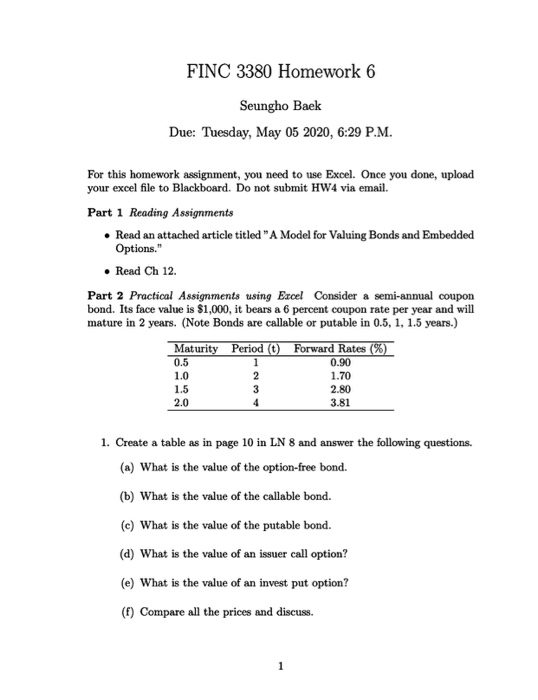

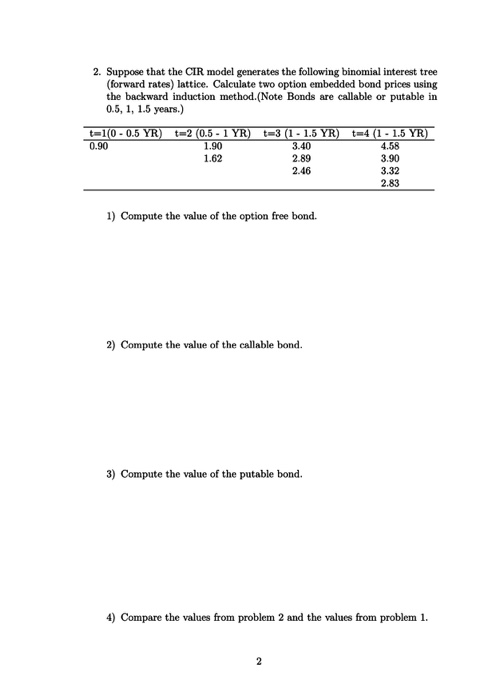

FINC 3380 Homework 6 Seungho Baek Due: Tuesday, May 05 2020, 6:29 P.M. For this homework assignment, you need to use Excel. Once you done, upload your excel file to Blackboard. Do not submit HW4 via email. Part 1 Reading Assignments Read an attached article titled "A Model for Valuing Bonds and Embedded Options." . Read Ch 12. Part 2 Practical Assignments using Excel Consider a semi-annual coupon bond. Its face value is $1,000, it bears a 6 percent coupon rate per year and will mature in 2 years. (Note Bonds are callable or putable in 0.5, 1, 1.5 years.) Period (t) Maturity 0.5 Forward Rates (%) 0.90 1.70 2.80 3.81 1. Create a table as in page 10 in LN 8 and answer the following questions. (a) What is the value of the option-free bond. (b) What is the value of the callable bond. (e) What is the value of the putable bond. (d) What is the value of an issuer call option? (e) What is the value of an invest put option? (1) Compare all the prices and discuss. 2. Suppose that the CIR model generates the following binomial interest tree (forward rates) lattice. Calculate two option embedded bond prices using the backward induction method.(Note Bonds are callable or putable in 0.5, 1, 1.5 years.) t-10-0.5 YR) 0.90 -2 (0.5 - 1 YR) 4 (1 - 1.5 YR) 1.90 =3 (1 - 1.5 YR) 3.40 2.89 2.46 1.62 3.32 1) Compute the value of the option free bond. 2) Compute the value of the callable bond. 3) Compute the value of the putable bond. 4) Compare the values from problem 2 and the values from problem 1. FINC 3380 Homework 6 Seungho Baek Due: Tuesday, May 05 2020, 6:29 P.M. For this homework assignment, you need to use Excel. Once you done, upload your excel file to Blackboard. Do not submit HW4 via email. Part 1 Reading Assignments Read an attached article titled "A Model for Valuing Bonds and Embedded Options." . Read Ch 12. Part 2 Practical Assignments using Excel Consider a semi-annual coupon bond. Its face value is $1,000, it bears a 6 percent coupon rate per year and will mature in 2 years. (Note Bonds are callable or putable in 0.5, 1, 1.5 years.) Period (t) Maturity 0.5 Forward Rates (%) 0.90 1.70 2.80 3.81 1. Create a table as in page 10 in LN 8 and answer the following questions. (a) What is the value of the option-free bond. (b) What is the value of the callable bond. (e) What is the value of the putable bond. (d) What is the value of an issuer call option? (e) What is the value of an invest put option? (1) Compare all the prices and discuss. 2. Suppose that the CIR model generates the following binomial interest tree (forward rates) lattice. Calculate two option embedded bond prices using the backward induction method.(Note Bonds are callable or putable in 0.5, 1, 1.5 years.) t-10-0.5 YR) 0.90 -2 (0.5 - 1 YR) 4 (1 - 1.5 YR) 1.90 =3 (1 - 1.5 YR) 3.40 2.89 2.46 1.62 3.32 1) Compute the value of the option free bond. 2) Compute the value of the callable bond. 3) Compute the value of the putable bond. 4) Compare the values from problem 2 and the values from problem 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts