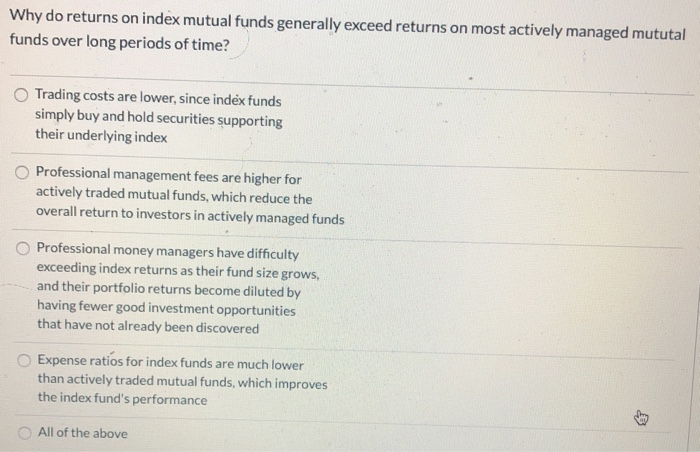

Question: Why do returns on index mutual funds generally exceed returns on most actively managed mututal funds over long periods of time? Trading costs are lower,

Why do returns on index mutual funds generally exceed returns on most actively managed mututal funds over long periods of time? Trading costs are lower, since index funds simply buy and hold securities supporting their underlying index Professional management fees are higher for actively traded mutual funds, which reduce the overall return to investors in actively managed funds Professional money managers have difficulty exceeding index returns as their fund size grows, and their portfolio returns become diluted by having fewer good investment opportunities that have not already been discovered Expense ratios for index funds are much lower than actively traded mutual funds, which improves the index fund's performance All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts