Question: why do you add 1 to 0.05 for variable cost under worst case? Leopard Machinery is analyzing a proposed project. The company expects to sell

why do you add 1 to 0.05 for variable cost under worst case?

why do you add 1 to 0.05 for variable cost under worst case?

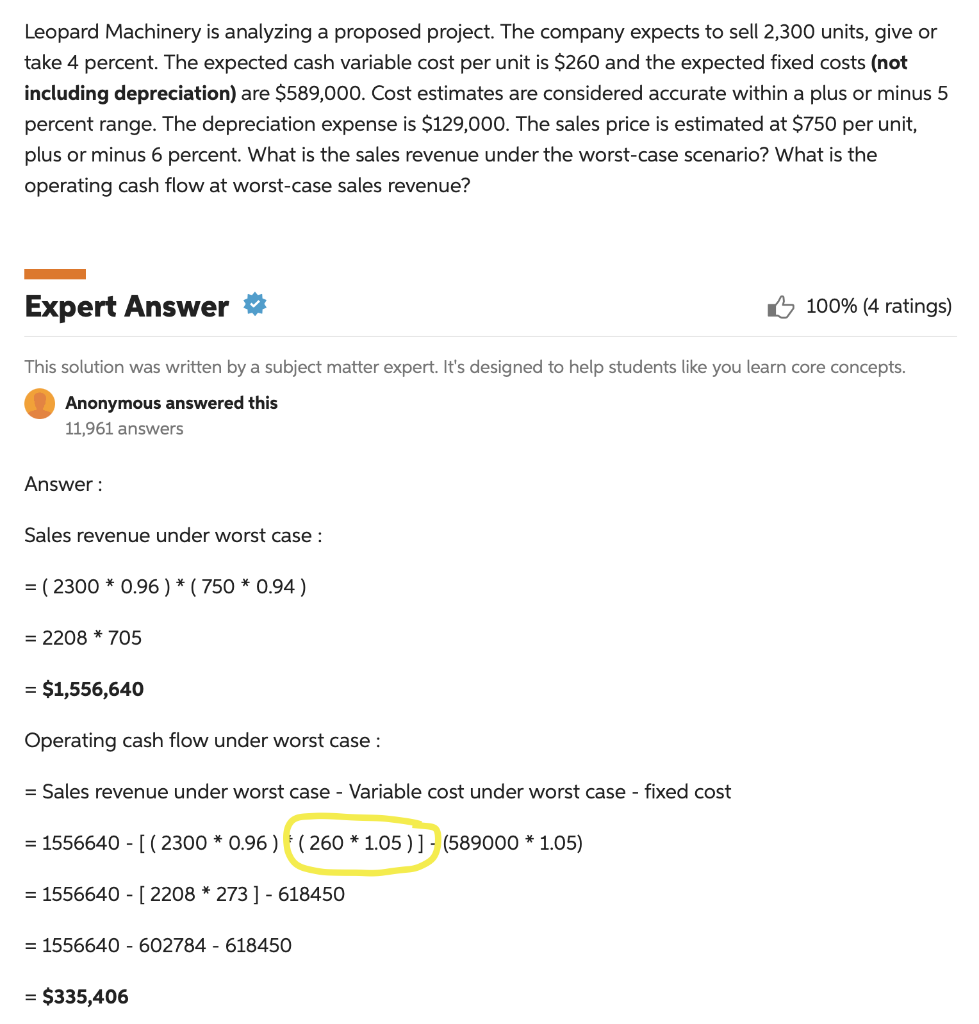

Leopard Machinery is analyzing a proposed project. The company expects to sell 2,300 units, give or take 4 percent. The expected cash variable cost per unit is $260 and the expected fixed costs (not including depreciation) are $589,000. Cost estimates are considered accurate within a plus or minus 5 percent range. The depreciation expense is $129,000. The sales price is estimated at $750 per unit, plus or minus 6 percent. What is the sales revenue under the worst-case scenario? What is the operating cash flow at worst-case sales revenue? Expert Answer 100% (4 ratings) This solution was written by a subject matter expert. It's designed to help students like you learn core concepts. Anonymous answered this 11,961 answers Answer : Sales revenue under worst case : =(23000.96)(7500.94)=2208705=$1,556,640 Operating cash flow under worst case : =SalesrevenueunderworstcaseVariablecostunderworstcasefixedcost=1556640[(23000.96)(2601.05)](5890001.05)=1556640[2208273]618450=1556640602784618450=$335,406

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts