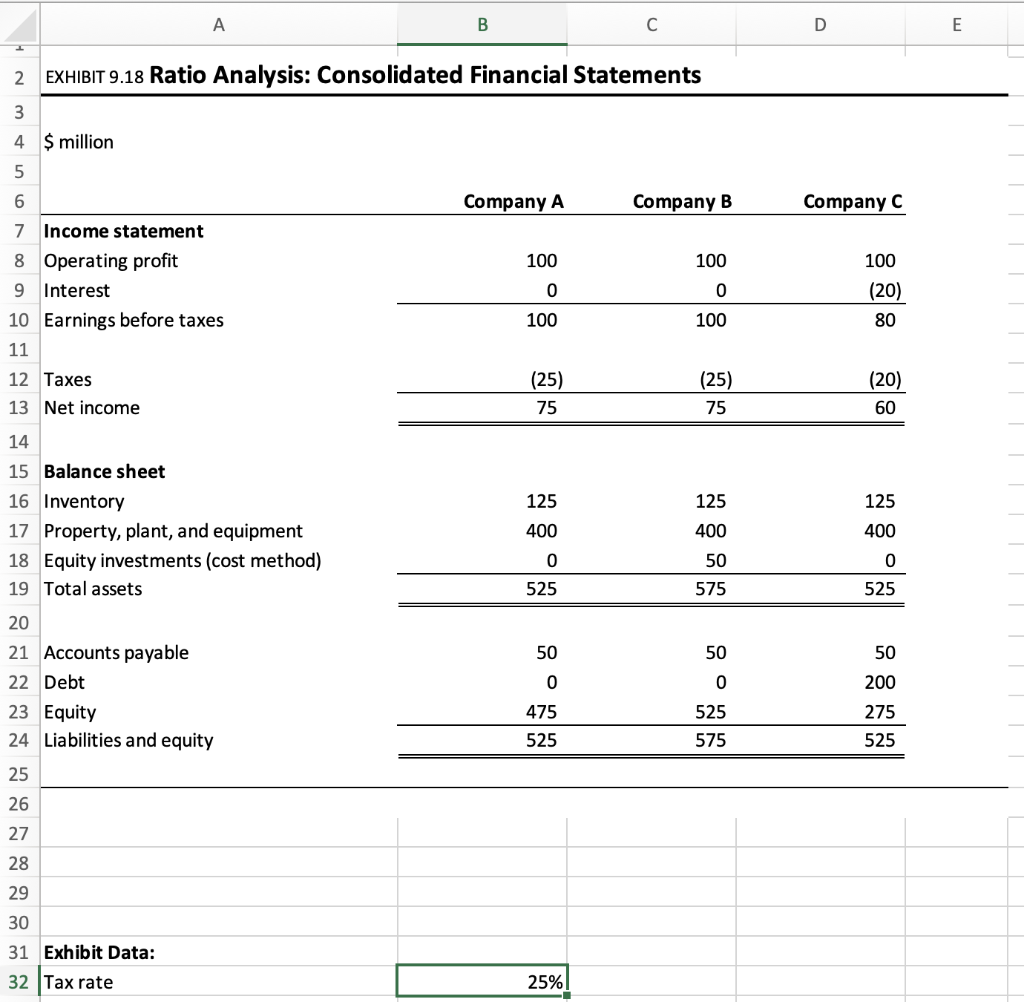

Question: why does the return on equity differ between Company A and company C? Is the difference attributable to operating performance? which better reflects operating performance,

why does the return on equity differ between Company A and company C? Is the difference attributable to operating performance? which better reflects operating performance, return on assets or return on equity? why?

**note assume that income statement is for current year and balance sheet is for the prior year, so that you can divide the current year net income by prior year equity to compute ROE.

B D E 2 EXHIBIT 9.18 Ratio Analysis: Consolidated Financial Statements 3 4 $ million 5 6 Company A Company B Company C 100 100 100 7 Income statement 8 Operating profit 9 Interest 10 Earnings before taxes 11 0 0 (20) 80 100 100 (20) 12 Taxes 13 Net income (25) 75 (25) 75 60 125 125 125 14 15 Balance sheet 16 Inventory 17 Property, plant, and equipment 18 Equity investments (cost method) 19 Total assets 400 400 400 0 0 50 575 525 525 50 50 50 0 0 200 275 20 21 Accounts payable 22 Debt 23 Equity 24 Liabilities and equity 25 26 27 475 525 525 575 525 28 29 30 31 Exhibit Data: 32 Tax rate 25% B D E 2 EXHIBIT 9.18 Ratio Analysis: Consolidated Financial Statements 3 4 $ million 5 6 Company A Company B Company C 100 100 100 7 Income statement 8 Operating profit 9 Interest 10 Earnings before taxes 11 0 0 (20) 80 100 100 (20) 12 Taxes 13 Net income (25) 75 (25) 75 60 125 125 125 14 15 Balance sheet 16 Inventory 17 Property, plant, and equipment 18 Equity investments (cost method) 19 Total assets 400 400 400 0 0 50 575 525 525 50 50 50 0 0 200 275 20 21 Accounts payable 22 Debt 23 Equity 24 Liabilities and equity 25 26 27 475 525 525 575 525 28 29 30 31 Exhibit Data: 32 Tax rate 25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts