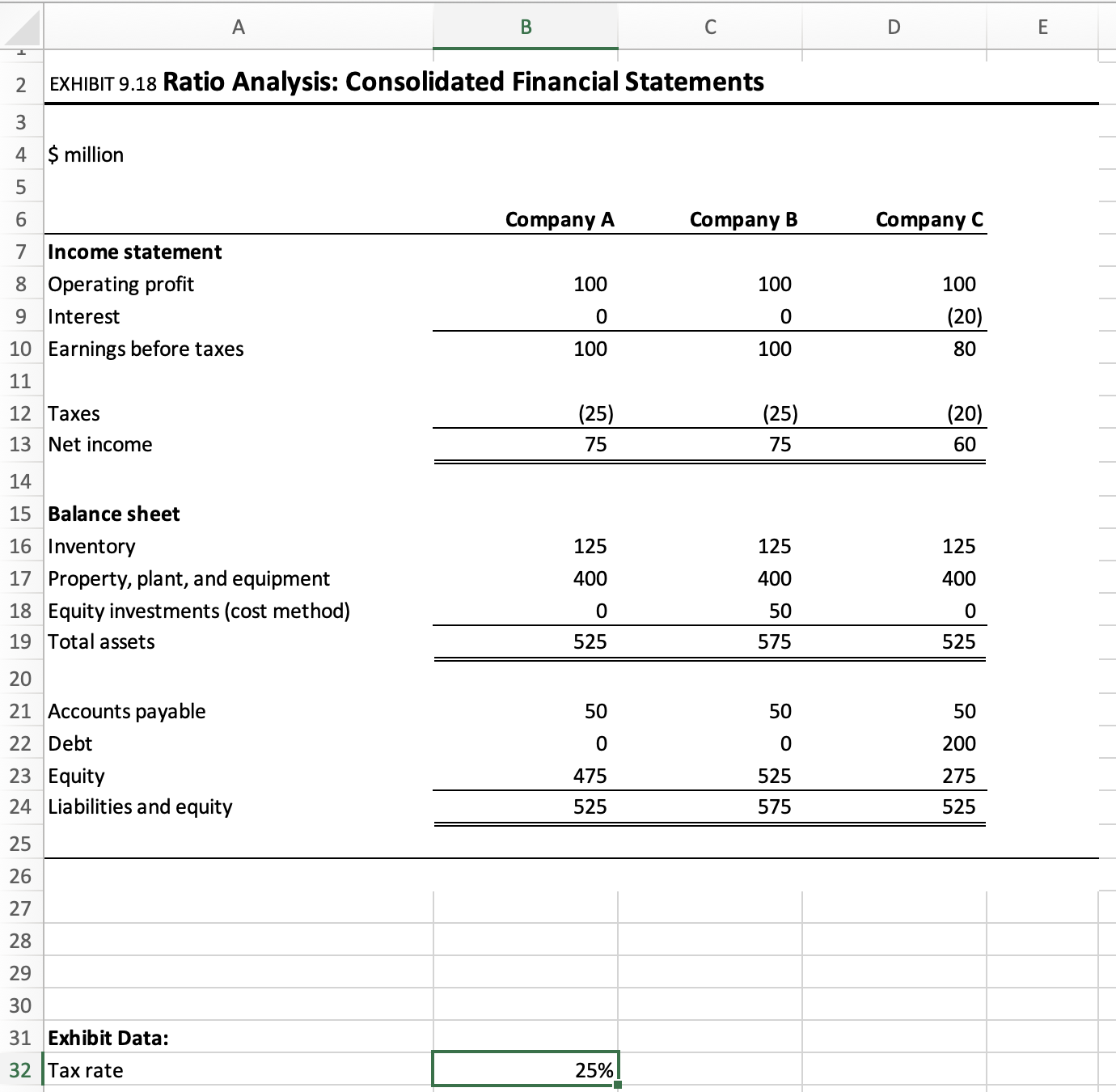

Question: why does the return on equity differ between Company A and company C? Is the difference attributable to operating performance? which better reflects operating performance,

why does the return on equity differ between Company A and company C? Is the difference attributable to operating performance? which better reflects operating performance, return on assets or return on equity? why?

**note assume that income statement is for current year and balance sheet is for the prior year, so that you can divide the current year net income by prior year equity to compute ROE.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts