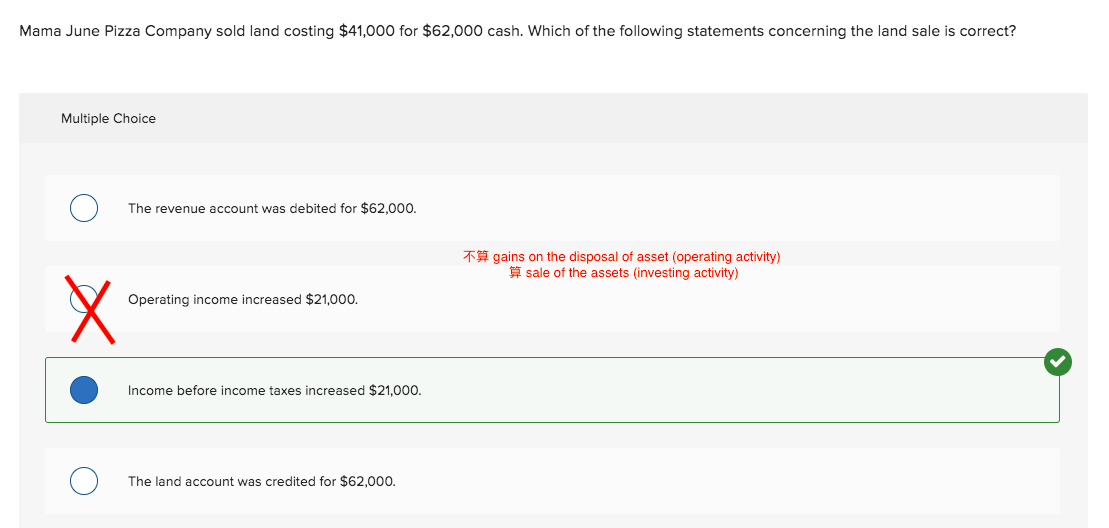

Question: Why I cannot consider it as a gains on the disposal of the asset, thereby increasing the operating income by 21000. What is the difference

Why I cannot consider it as a gains on the disposal of the asset, thereby increasing the operating income by 21000. What is the difference between the sale/acquisition of the assets and loss/gains on the disposal of the assets? I think they are all selling the assets, so I cannot figure it out.

Mama June Pizza Company sold land costing $41,000 for $62,000 cash. Which of the following statements concerning the land sale is correct? Multiple Choice The revenue account was debited for $62,000. gains on the disposal of asset (operating activity) sale of the assets (investing activity) X Operating income increased $21,000. Income before income taxes increased $21,000. The land account was credited for $62,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts