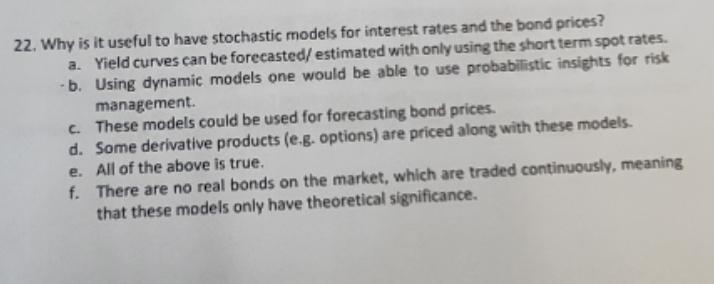

Question: Why is it useful to have stochastic models for interest rates and the bond prices? a . Yield curves can be forecasted / estimated with

Why is it useful to have stochastic models for interest rates and the bond prices?

a Yield curves can be forecasted estimated with only using the short term spot rates.

b Using dynamic models one would be able to use probabilistic insights for risk management.

c These models could be used for forecasting bond prices.

d Some derivative products eg options are priced along with these models.

e All of the above is true.

f There are no real bonds on the market, which are traded continuously, meaning that these models only have theoretical significance.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock