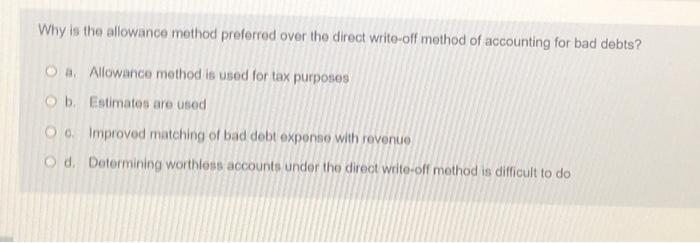

Question: Why is the allowance method preferred over the direct write-off mothod of accounting for bad debts? 3. Allowance method is used for tax purposes b.

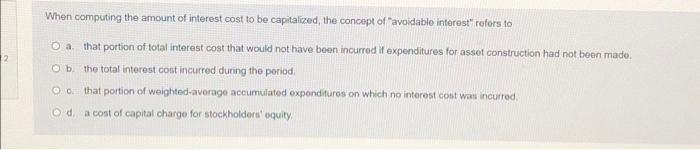

Why is the allowance method preferred over the direct write-off mothod of accounting for bad debts? 3. Allowance method is used for tax purposes b. Estimates are used 0. Improved matching of bad debt expense with revenue d. Determining worthless accounts under the direot write-off method is difficult to do When computing the amount of interest cost to be capitalized, the concept of "avoidablo interest" refors to a. that portion of total interest cost that would not have been incurred if expenditures for asset construction had not been made. b. the total intorest cost incurred during the period. c. that portion of weighted-average accumulated exponditures on which no interest cost was incurred. d. a cost of capital charge for stoekholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts