Question: Why is the answer C? can u help give the working Question 11 The two-month interest rates in Switzerland and the United States are 2%

Why is the answer C? can u help give the working

Why is the answer C? can u help give the working

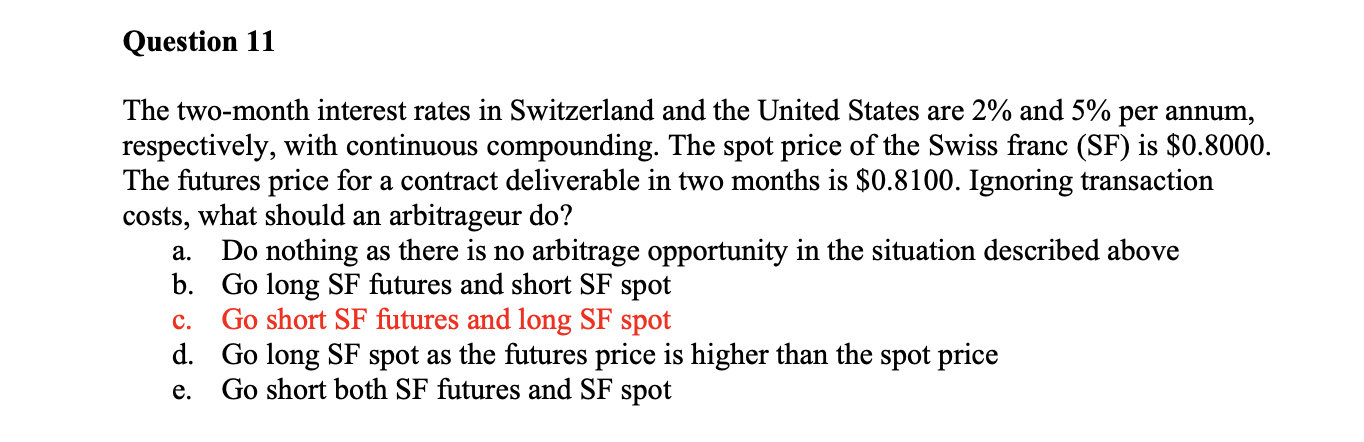

Question 11 The two-month interest rates in Switzerland and the United States are 2% and 5% per annum, respectively, with continuous compounding. The spot price of the Swiss franc (SF) is $0.8000. The futures price for a contract deliverable in two months is $0.8100. Ignoring transaction costs, what should an arbitrageur do? Do nothing as there is no arbitrage opportunity in the situation described above b. Go long SF futures and short SF spot Go short SF futures and long SF spot d. Go long SF spot as the futures price is higher than the spot price Go short both SF futures and SF spot a. c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts