Question: Why is the answer E . ( $ 2 1 0 , 0 0 0 ) ? On August 1 , 2 0 1 8

Why is the answer E$

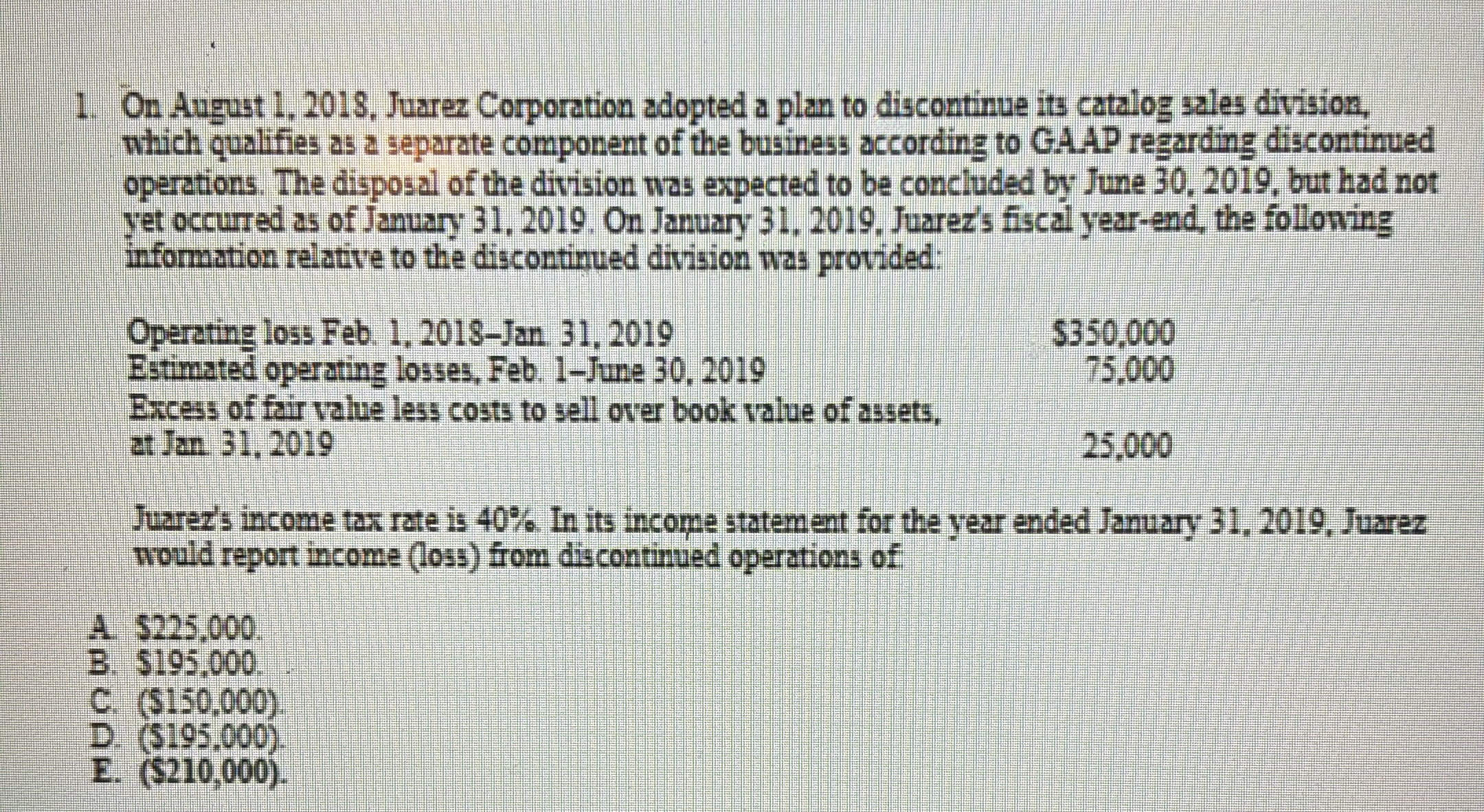

On August Juarez Corporation adopted a plan to discontinue its catalog sales division,

which qualifies as a separate component of the business according to GAAP regarding discontinued

operations. The disposal of the division was expected to be concluded by June but had not

yet occurred as of January On January Juarez's fiscal yearend, the following

information relative to the discontinued division was provided:

Operating loss Feb. Jan.

Estimated operating losses, Feb. June

Excess of fair value less costs to sell over book value of assets,

at Jan

Juarez's income tax rate is In its income statement for the year ended January Juarez

would report income loss from discontinued operations of

A $

B $

C$

D$

E$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock