Question: Why is the variance 0.30 in the answer key when the std deviation is 0.30 in the question? expected dividends on the asset, the strike

Why is the variance 0.30 in the answer key when the std deviation is 0.30 in the question?

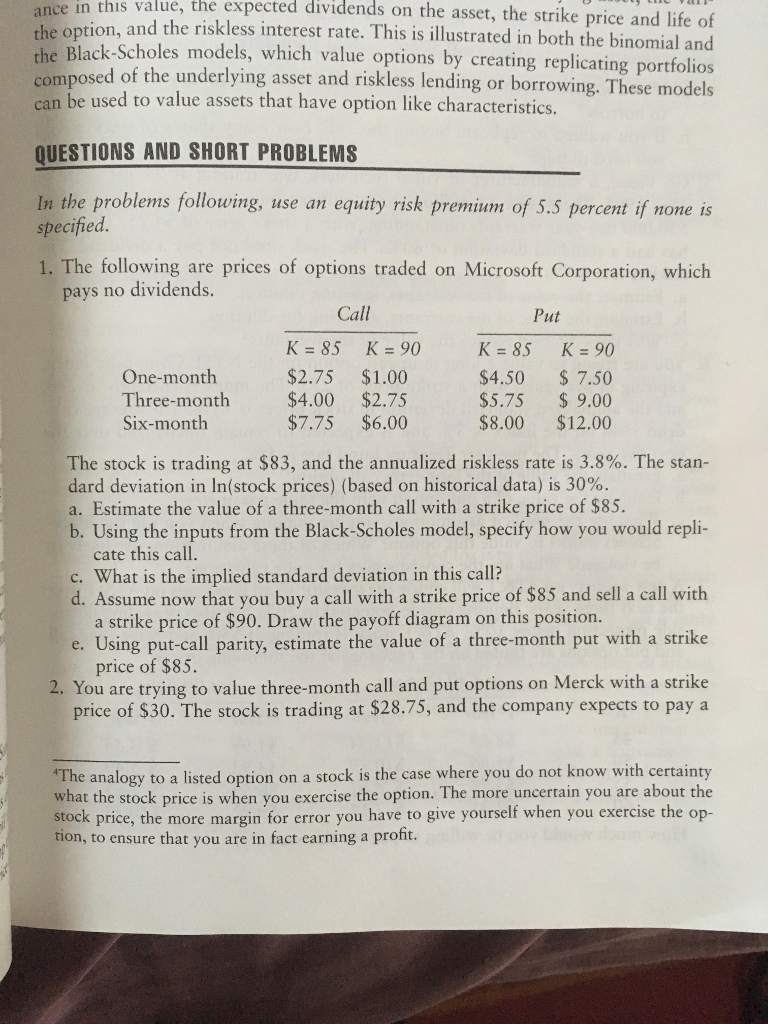

expected dividends on the asset, the strike price and life of this value, the ance the option, in and the riskless interest rate. This is illustrated in both the binomial and che Blac Bl ack-Scholes models, which value options by creating replicating portfolios sed of the underlying asset and riskless lending or borrowing. These models used to value assets that have option like characteristics n be QUESTIONS AND SHORT PROBLEMS In the problems following, use an equity risk premium of 5.5 percent if none is specified 1. The following are prices of options traded on Microsoft Corporation, which pays no dividends Call Put K 85 K90 $2.75 $1.00 $4.00 $2.75 $7.75 $6.00 K=85 K=90 $ 7.50 One-month Three-month Six-month $2.75 $4.s0 $6.00 $5.75 $8.00 $12.00 The stock is trading at $83, and the annualized riskless rate is 3.8%. The stan- dard deviation in ln(stock prices) (based on historical data) s 30%. a. Estimate the value of a three-month call with a strike price of $85 b. Using the inputs from the Black-Scholes model, specify how you would repli- d. Assume now that you buy a call with a strike price of $85 and sell a call with e. Using put-call parity, estimate the value of a three-month put with a strike cate this call c. What is the implied standard deviation in this call? a strike price of $90. Draw the payoff diagram on this position. price of $85 2. You are trying to value three-month call and put options on Merck with a strike price of $30. The stock is trading at $28.75, and the company expects to paya "The analogy to a listed option on a stock is the case where you do not know with certainty what the stock price is when you exercise the option. The more uncertain you are about the stock price, the more margin for error you have to give yourself when you exercise the op tion, to ensure that you are in fact earning a proht

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts