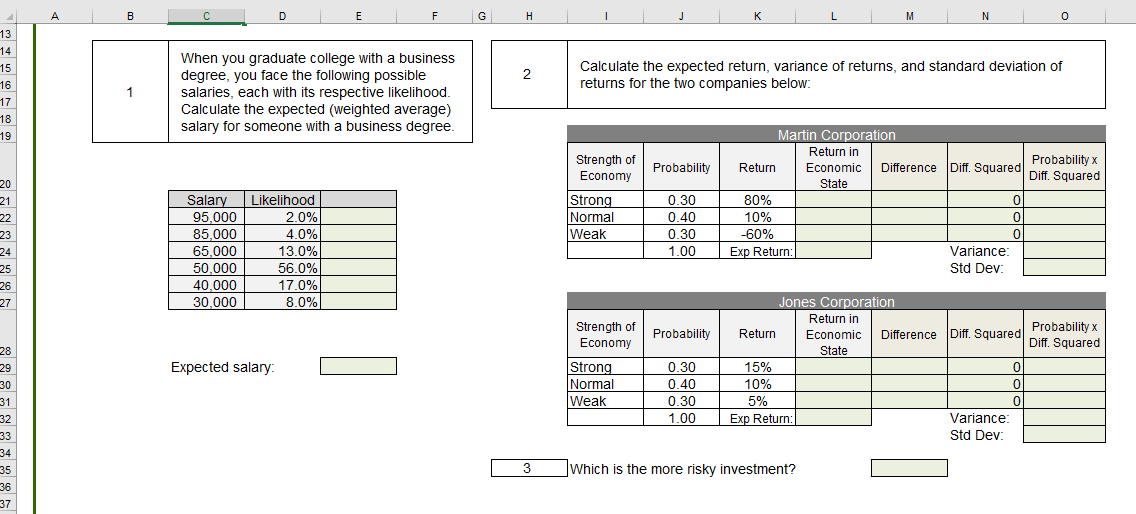

Question: . B D E F G G H 1 L M N 0 2 13 14 15 16 17 18 19 When you graduate college

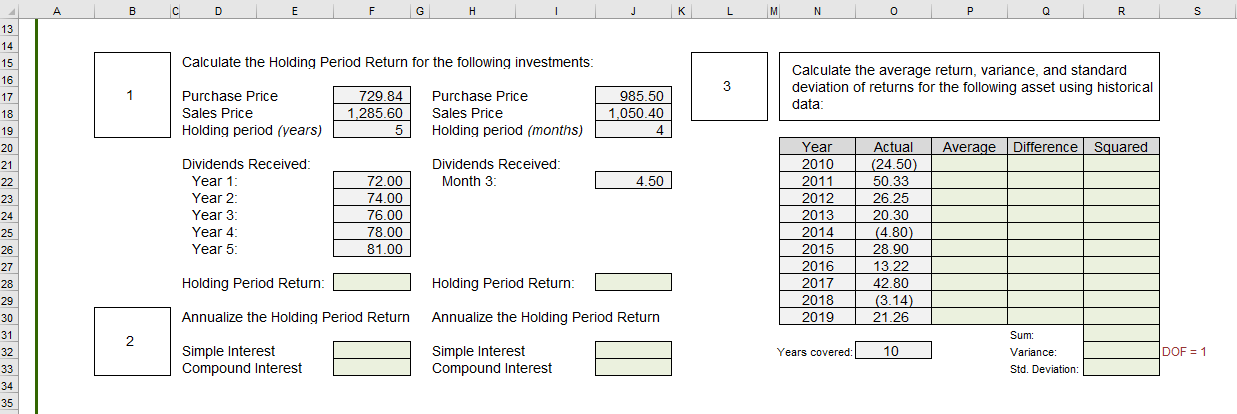

. B D E F G G H 1 L M N 0 2 13 14 15 16 17 18 19 When you graduate college with a business degree, you face the following possible salaries, each with its respective likelihood. Calculate the expected (weighted average) salary for someone with a business degree. Calculate the expected return, variance of returns, and standard deviation of returns for the two companies below 1 Probability Strength of Economy Strong Normal Weak 20 21 22 23 24 25 26 27 Salary 95,000 85,000 65,000 50.000 40.000 30,000 Likelihood 2.0% 4.0% 13.0% 56.0% 17.0% 8.0% 0.30 0.40 0.30 1.00 Martin Corporation Return in Return Probability x Economic Difference Diff. Squared Diff . Squared State 80% 01 10% -60% 0 Exp Return Variance: Std Dev: Probability Probability x Diff. Squared Expected salary Strength of Economy Strong Normal Weak 0.30 0.40 0.30 1.00 28 29 30 31 32 33 34 35 36 37 Jones Corporation Return in Return Economic Difference Diff. Squared State 15% 0 10% 0 5% 0 Exp Return: Variance Std Dev 3 Which is the more risky investment? B H M N Q S Calculate the Holding Period Return for the following investments: 3 Calculate the average return, variance, and standard deviation of returns for the following asset using historical data: 1 Purchase Price Sales Price Holding period (years) 729.84 1,285.60 5 Purchase Price Sales Price Holding period (months) 985.50 1,050.40 4 Average Difference Squared Dividends Received: Month 3 4.50 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Dividends Received: Year 1 Year 2 Year 3: Year 4: Year 5: 72.00 74.00 76.00 78.00 81.00 Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Actual (24.50) 50.33 26.25 20.30 (4.80 28.90 13.22 42.80 (3.14) 21.26 Holding Period Return: Holding Period Return Annualize the Holding Period Return Annualize the Holding Period Return Sum 2 Years covered: 10 DOF = 1 Simple Interest Compound Interest Simple Interest Compound Interest Variance: Std. Deviation . B D E F G G H 1 L M N 0 2 13 14 15 16 17 18 19 When you graduate college with a business degree, you face the following possible salaries, each with its respective likelihood. Calculate the expected (weighted average) salary for someone with a business degree. Calculate the expected return, variance of returns, and standard deviation of returns for the two companies below 1 Probability Strength of Economy Strong Normal Weak 20 21 22 23 24 25 26 27 Salary 95,000 85,000 65,000 50.000 40.000 30,000 Likelihood 2.0% 4.0% 13.0% 56.0% 17.0% 8.0% 0.30 0.40 0.30 1.00 Martin Corporation Return in Return Probability x Economic Difference Diff. Squared Diff . Squared State 80% 01 10% -60% 0 Exp Return Variance: Std Dev: Probability Probability x Diff. Squared Expected salary Strength of Economy Strong Normal Weak 0.30 0.40 0.30 1.00 28 29 30 31 32 33 34 35 36 37 Jones Corporation Return in Return Economic Difference Diff. Squared State 15% 0 10% 0 5% 0 Exp Return: Variance Std Dev 3 Which is the more risky investment? B H M N Q S Calculate the Holding Period Return for the following investments: 3 Calculate the average return, variance, and standard deviation of returns for the following asset using historical data: 1 Purchase Price Sales Price Holding period (years) 729.84 1,285.60 5 Purchase Price Sales Price Holding period (months) 985.50 1,050.40 4 Average Difference Squared Dividends Received: Month 3 4.50 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Dividends Received: Year 1 Year 2 Year 3: Year 4: Year 5: 72.00 74.00 76.00 78.00 81.00 Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Actual (24.50) 50.33 26.25 20.30 (4.80 28.90 13.22 42.80 (3.14) 21.26 Holding Period Return: Holding Period Return Annualize the Holding Period Return Annualize the Holding Period Return Sum 2 Years covered: 10 DOF = 1 Simple Interest Compound Interest Simple Interest Compound Interest Variance: Std. Deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts