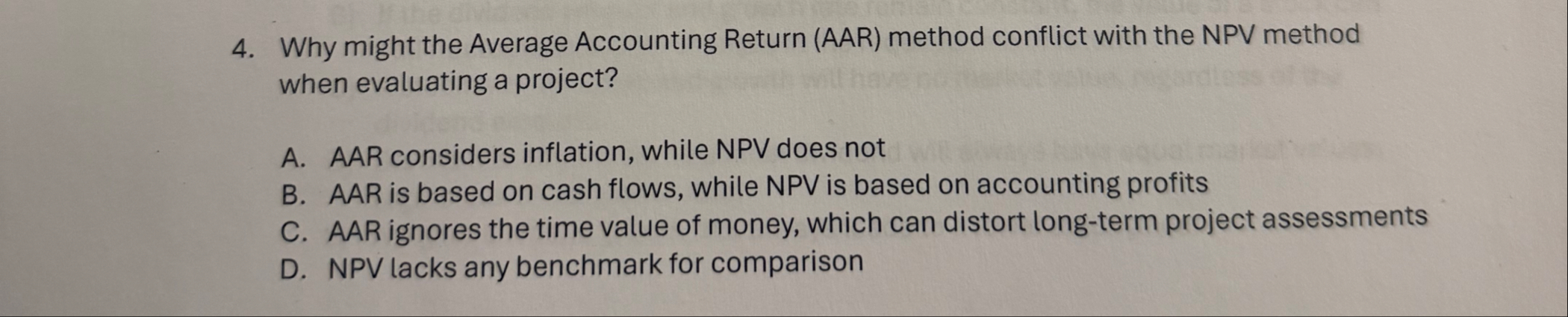

Question: Why might the Average Accounting Return ( AAR ) method conflict with the NPV method when evaluating a project? A . AAR considers inflation, while

Why might the Average Accounting Return AAR method conflict with the NPV method when evaluating a project?

A AAR considers inflation, while NPV does not

B AAR is based on cash flows, while NPV is based on accounting profits

C AAR ignores the time value of money, which can distort longterm project assessments

D NPV lacks any benchmark for comparison

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock