Question: why we put goodwill 200? and when we put gain on bargain purchase? 1. Payne acquires 30% of Sloan for $5,000. Sloan's identifiable net assets

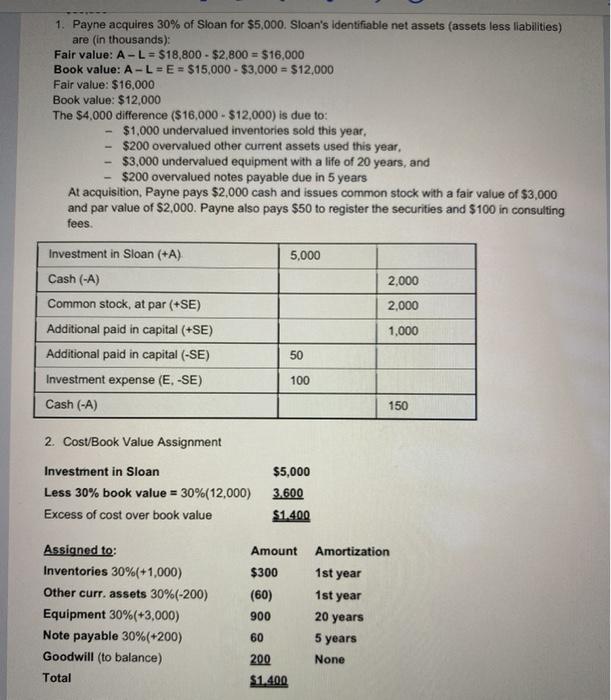

1. Payne acquires 30% of Sloan for $5,000. Sloan's identifiable net assets (assets less liabilities) are (in thousands): Fair value: A-L = $18,800 - $2,800 = $16,000 Book value: A-L=E = $15,000 - $3,000 = $12,000 Fair value: $16.000 Book value: $12,000 The $4.000 difference ($16,000 - $12,000) is due to: $1,000 undervalued inventories sold this year, $200 overvalued other current assets used this year, $3,000 undervalued equipment with a life of 20 years, and $200 overvalued notes payable due in 5 years At acquisition, Payne pays $2,000 cash and issues common stock with a fair value of $3,000 and par value of $2,000. Payne also pays $50 to register the securities and $100 in consulting fees Investment in Sloan (+A) 5,000 Cash (-A) 2,000 Common stock, at par (+SE) 2,000 Additional paid in capital (+SE) 1,000 Additional paid in capital (-SE) 50 Investment expense (E.-SE) 100 Cash (-A) 150 2. Cost/Book Value Assignment Investment in Sloan Less 30% book value = 30%(12,000) Excess of cost over book value $5,000 3.600 $1.400 Amount Amortization Assigned to: Inventories 30%(+1,000) Other curr, assets 30%(-200) Equipment 30%(+3,000) Note payable 30%(+200) Goodwill (to balance) Total $300 (60) 900 1st year 1st year 20 years 5 years 60 None 200 $1.400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts