Question: will definitely give a like! 1. (5 points) One year ago, you bought the ABC bond with a maturity of 30 years for $980. The

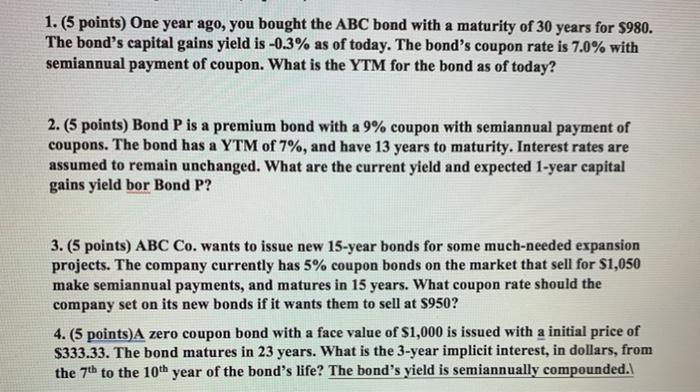

1. (5 points) One year ago, you bought the ABC bond with a maturity of 30 years for $980. The bond's capital gains yield is -0.3% as of today. The bond's coupon rate is 7.0% with semiannual payment of coupon. What is the YTM for the bond as of today? 2. (5 points) Bond P is a premium bond with a 9% coupon with semiannual payment of coupons. The bond has a YTM of 7%, and have 13 years to maturity. Interest rates are assumed to remain unchanged. What are the current yield and expected 1-year capital gains yield bor Bond P? 3. (5 points) ABC Co. wants to issue new 15-year bonds for some much-needed expansion projects. The company currently has 5% coupon bonds on the market that sell for $1,050 make semiannual payments, and matures in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at $950? 4. (5 points)A zero coupon bond with a face value of $1,000 is issued with a initial price of $333.33. The bond matures in 23 years. What is the 3-year implicit interest, in dollars, from the 7th to the 10th year of the bond's life? The bond's yield is semiannually compounded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts