Question: will give a thumbs up thank you so much additional info let me know if you needed something else Instructions Compute cost of goods sold,

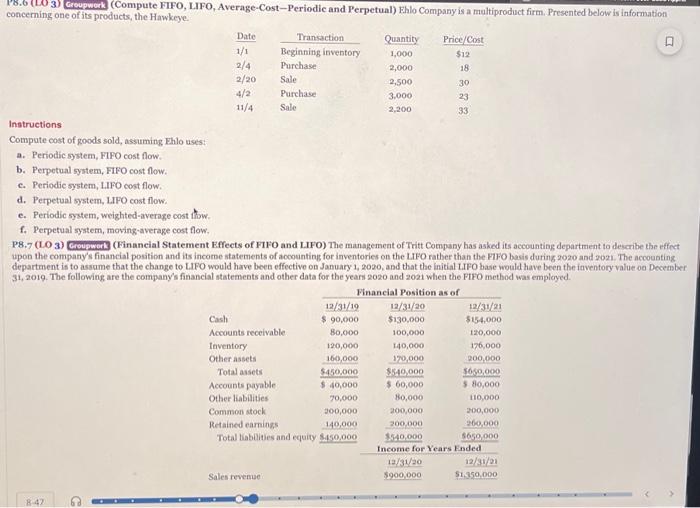

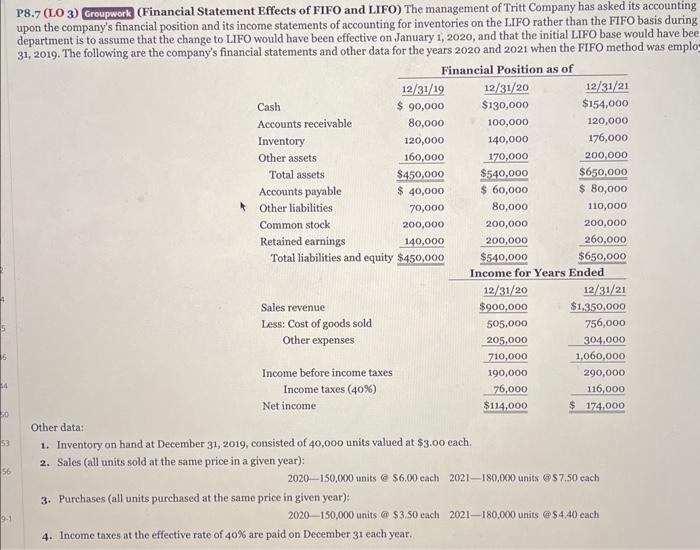

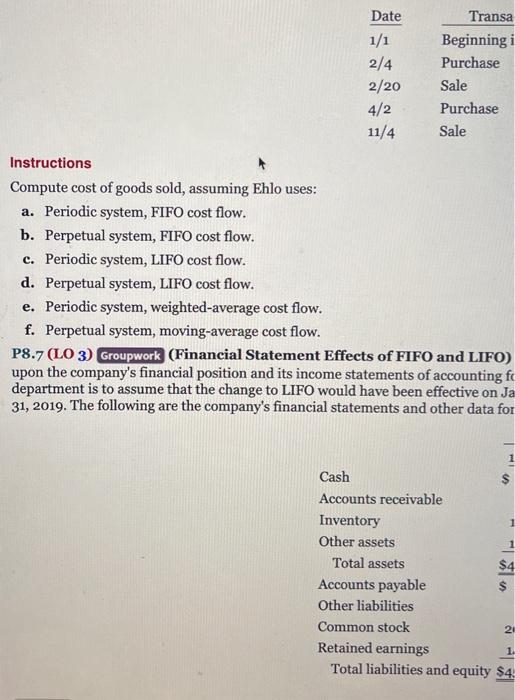

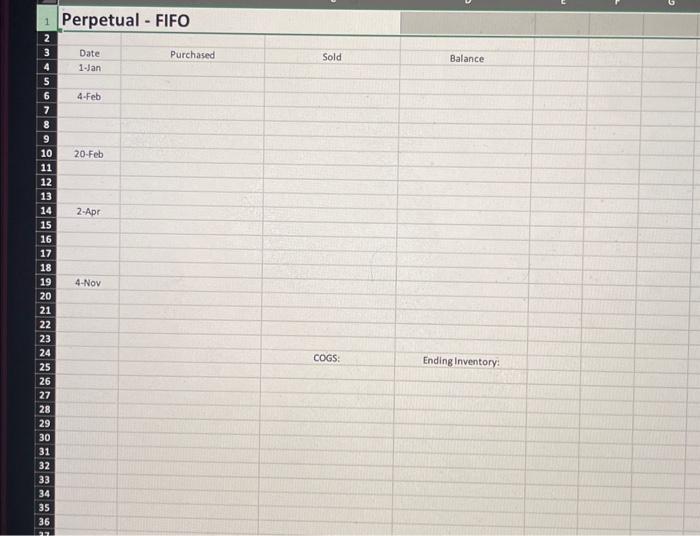

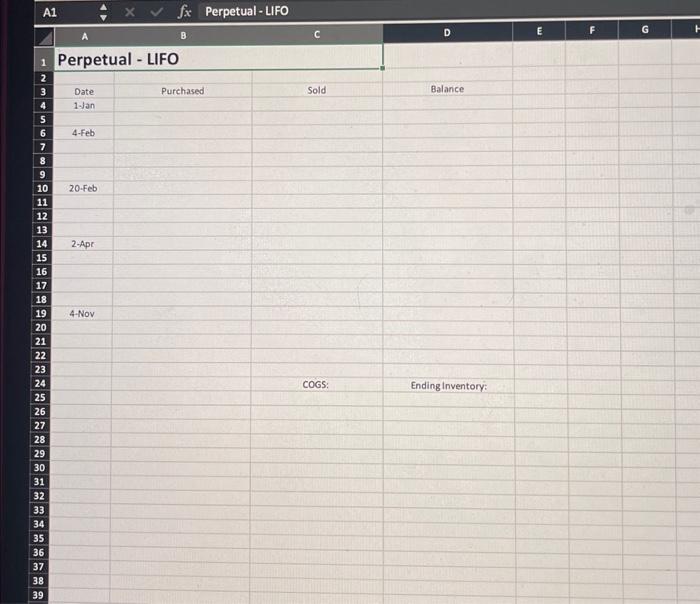

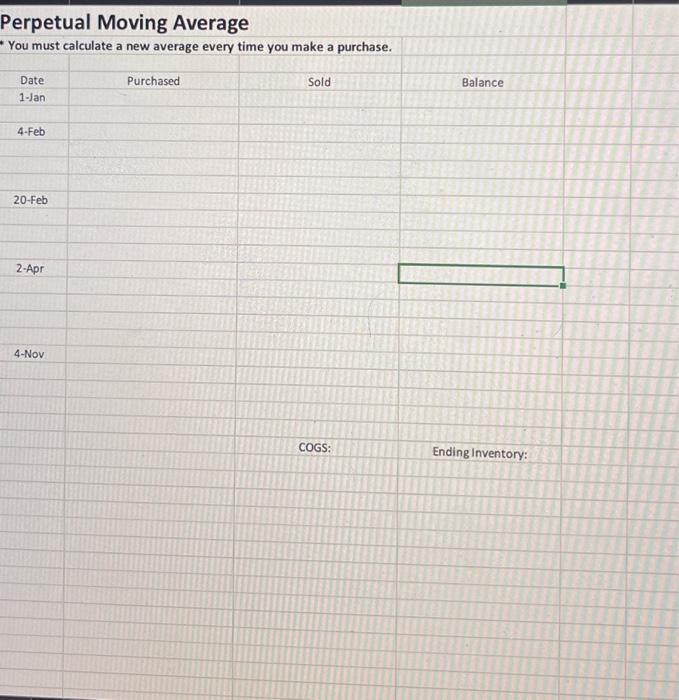

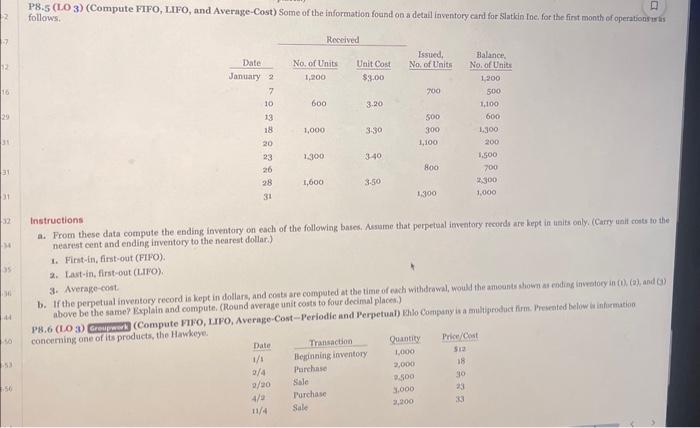

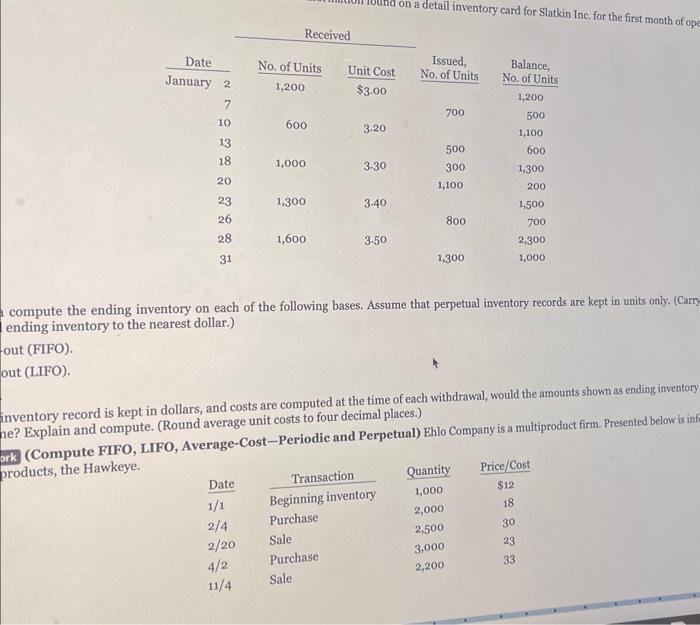

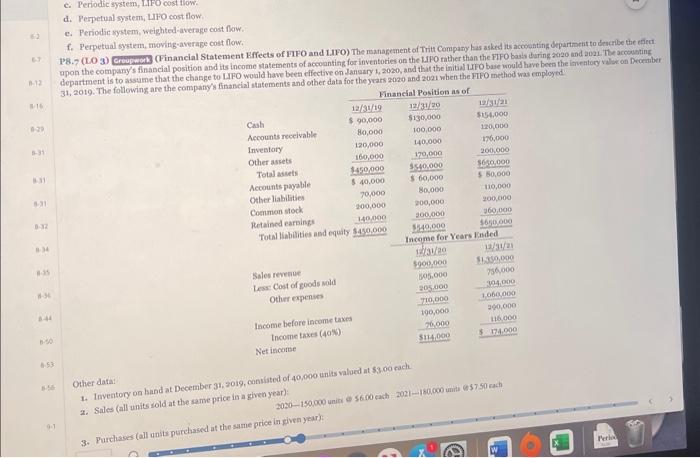

Instructions Compute cost of goods sold, assuming Phlo uses: a. Periodic system, FIFO cost flow. b. Perpetual system, FIFO cost flow. c. Periodic system, Lifo cost flow. d. Perpetual system, LFO cost flow. e. Periodic system, weighted-average cost thow. f. Perpetual system, moving-average cost flow. P8.7 ( LO3 ) Groupwer3 (Financial Statement Effects of FFFO and LIFO) The management of Tritt Company has asked its accounting departmient to describe the effect upon the company's financial position and its income statements of acoounting for inventories on the LFO rather than the F1FO basis during 2020 and 2021 . The accousting department is to assume that the change to LFO would have been effective on January 1,2020 , and that the initial LiFo base would have been the inventory value oe December 31,2019 . The following are the companys financial atatements and other data for the years 2020 and 2021 when the FiFo method was employed. P8.7 (LO 3 ) Groupwork (Financial Statement Effects of FIFO and LIFO) The management of Tritt Company has asked its accounting upon the company's financial position and its income statements of accounting for inventories on the LIFO rather than the FIFO basis during department is to assume that the change to LIFO would have been effective on January 1,2020, and that the initial LIFO base would have bee 31,2019 . The following are the company's financial statements and other data for the years 2020 and 2021 when the FIFO method was emplo Other data: 1. Inventory on hand at December 31,2019 , consisted of 40,000 units valued at $3.00 each. 2. Sales (all units sold at the same price in a given year): 2020150,000units&$6.00each2021180,000units&$7.50cach 3. Purchases (all units purchased at the same price in given year): 2020-150,000units@$3.50each2021180,000units$4,40each 4. Income taxes at the effective rate of 40% are paid on December 31 each year. Instructions Compute cost of goods sold, assuming Ehlo uses: a. Periodic system, FIFO cost flow. b. Perpetual system, FIFO cost flow. c. Periodic system, LIFO cost flow. d. Perpetual system, LIFO cost flow. e. Periodic system, weighted-average cost flow. f. Perpetual system, moving-average cost flow. P8.7 ( LO3 ) Groupwork (Financial Statement Effects of FIFO and LIFO) upon the company's financial position and its income statements of accounting fc department is to assume that the change to LIFO would have been effective on Ja 31,2019 . The following are the company's financial statements and other data for Perpetual Moving Average * You must calculate a new average every time you make a purchase. \begin{tabular}{|l|l|l|} \hline Date & Purchased & Sold \\ \hline 1-Jan & Balance \\ \hline 4-Feb & & \\ \hline 20-Feb & & \\ \hline 2-Apr & & \\ \hline 4-Nov & & \\ \hline \end{tabular} Periodic P8.5 ( LO3) (Compute FIFO, LFF, and Average-Cost) Some of the information found on a detail inventory cinil for Slatkin fne, for the fint month of operations uras follows. Instructions a. From these data compute the ending inventory on each of the following bases, Assume that perpetual imentory recurds are kept in inalis only, (Carry unit costs io the nearest cent and ending inventory to the nearest dollar.) 1. Firnt-in, first-out (FIFO). 2. East-in, first-out (LaFo). 3. Average-cost. above be the same? Raplain and compute, (Round average unit costs to four decimal places.) the Hawkeye. compute the ending inventory on each of the following bases. Assume that perpetual inventory records are kept in units only. (Carry ending inventory to the nearest dollar.) out (FIFO). ut (LIFO). nventory record is kept in dollars, and costs are computed at the time of each withdrawal, would the amounts shown as ending inventory e? Explain and compute. (Round average unit costs to four decimal places.) (Compute FIFO, LIFO, Average-Cost-Periodic and Perpetual) Ehlo Company is a multiproduct firm. Presented below is inf c. Periodic system, Lifo cost tiow. d. Perpetual system, Lifo cost flow. e. Periodic system, weighted-average cost fow. f. Ferpetual system, moving-average cost flow. 31, 2019 . The following are the company's finar-isl atatements and olher data for the yrars 2020 and 2021 when the FIFO method was employed Other data: 1. Inventory on land at December 31,2019 , cansisted of 40,000 unis valaed at 5,3,00 cach. 2. Sales (all units sold at the same price is a given year): 3. Purchases (all ansts purchased at the sume orice in piven your)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts