Question: Will highly rate for correct and complete answer. Required information Problem 15-3A (Algo) Debt investments in available-for-sale securities; unrealized and realized gains and losses LO

![losses LO P3 [The following information applies to the questions displayed below.]](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66e18879f0ed8_56966e1887994134.jpg)

Will highly rate for correct and complete answer.

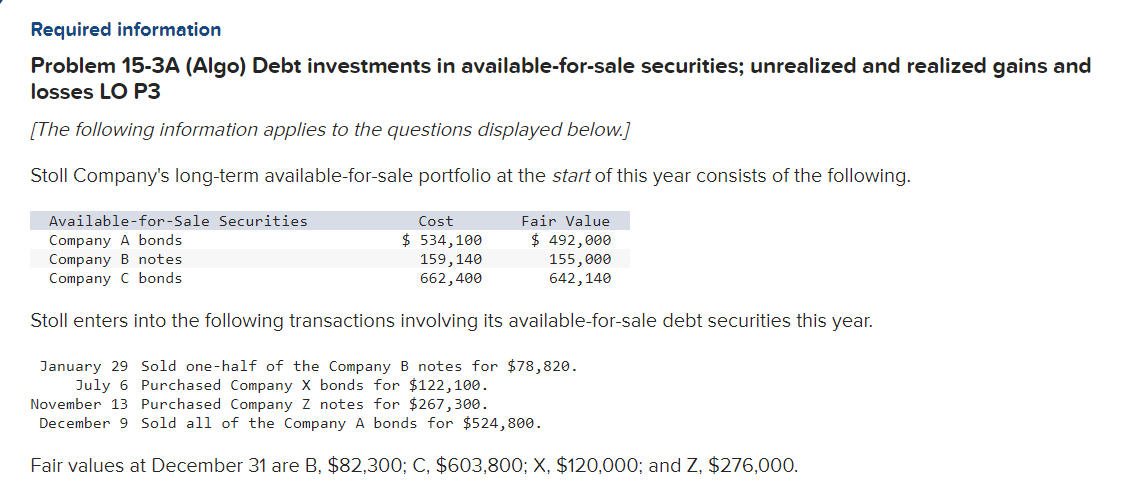

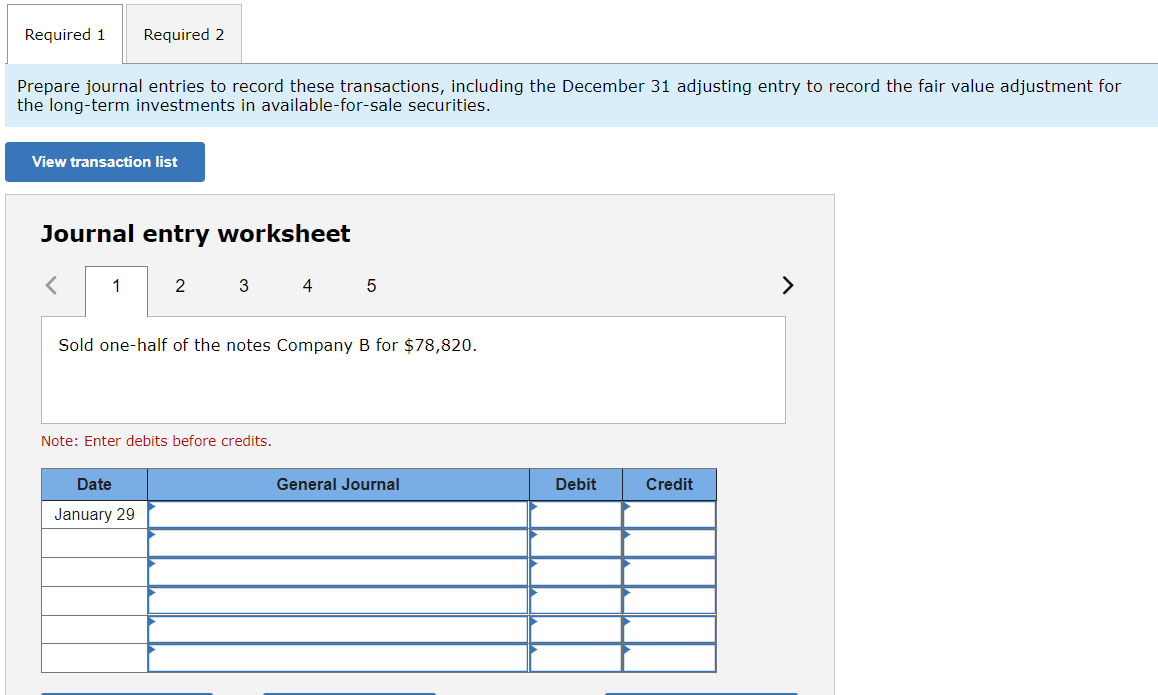

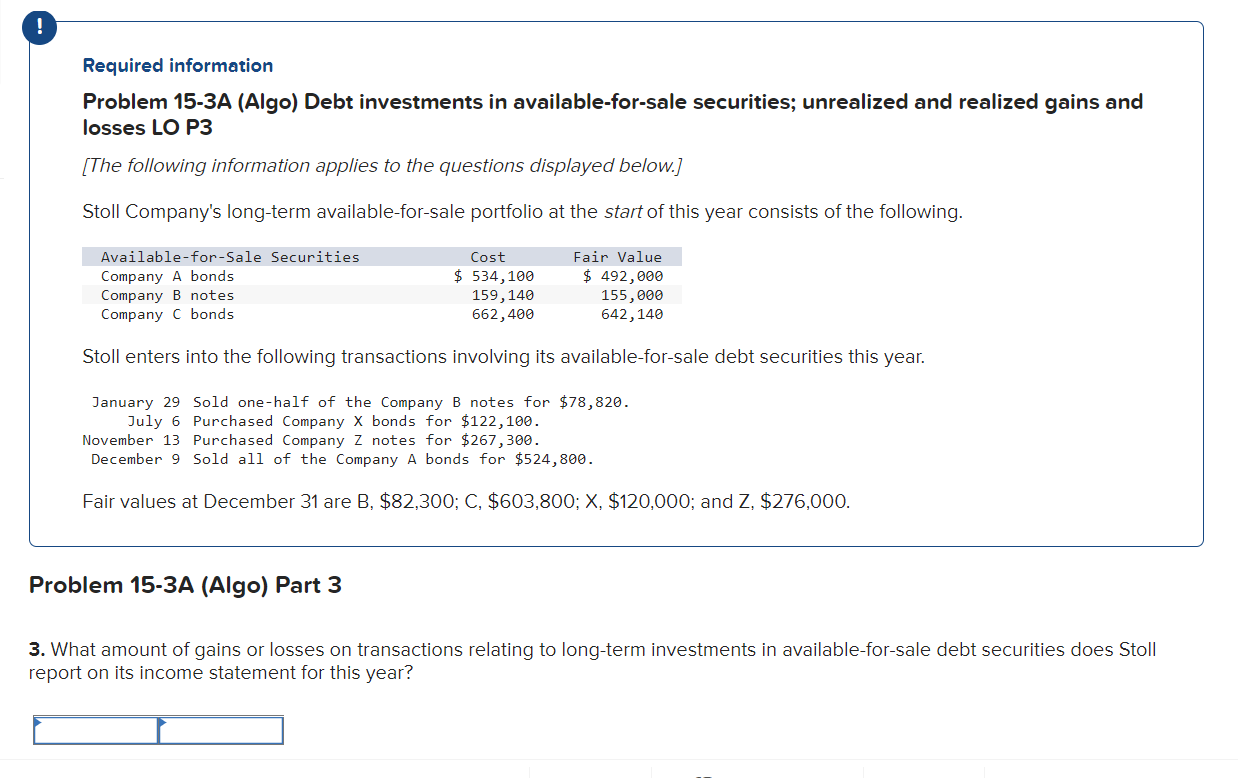

Required information Problem 15-3A (Algo) Debt investments in available-for-sale securities; unrealized and realized gains and losses LO P3 [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122,100. November 13 Purchased Company Z notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $82,300;, $603,800;X,$120,000; and Z, \$276,000. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. Journal entry worksheet Sold one-half of the notes Company B for $78,820. Note: Enter debits before credits. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale Problem 15-3A (Algo) Debt investments in available-for-sale securities; unrealized and realized gains and losses LO P3 [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122,100. November 13 Purchased Company Z notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B,$82,300;C,$603,800;X,$120,000; and Z,$276,000. roblem 15-3A (Algo) Part 3 What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll port on its income statement for this year? Required information Problem 15-3A (Algo) Debt investments in available-for-sale securities; unrealized and realized gains and losses LO P3 [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122,100. November 13 Purchased Company Z notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $82,300;, $603,800;X,$120,000; and Z, \$276,000. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. Journal entry worksheet Sold one-half of the notes Company B for $78,820. Note: Enter debits before credits. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale Problem 15-3A (Algo) Debt investments in available-for-sale securities; unrealized and realized gains and losses LO P3 [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122,100. November 13 Purchased Company Z notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B,$82,300;C,$603,800;X,$120,000; and Z,$276,000. roblem 15-3A (Algo) Part 3 What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll port on its income statement for this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts