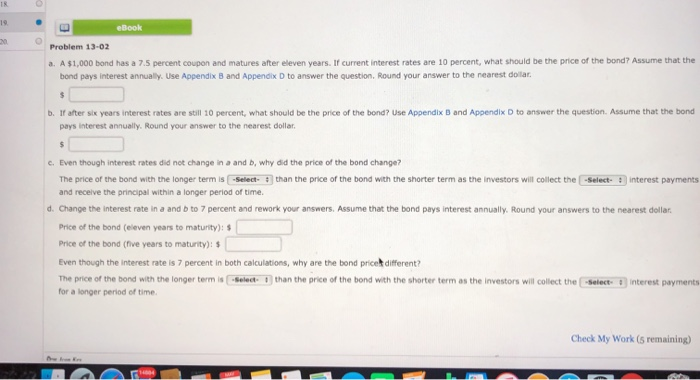

Question: will like for correct answer! 18 eBook 20 Problem 13-02 a. A $1,000 bond has a 7.5 percent coupon and matures after eleven years. If

18 eBook 20 Problem 13-02 a. A $1,000 bond has a 7.5 percent coupon and matures after eleven years. If current interest rates are 10 percent, what should be the price of the bond? Assume that the bond pays interest annually. Use Appendix 8 and Appendix D to answer the question, Round your answer to the nearest doilar b. If after six years interest rates are still 10 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond pays interest annually. Round your answer to the nearest dollar c. Even though interest rates did net change in a and b, why did the price of the bond change? The price of the bond with the longer term is Select and receive the principal within a longer period of time than the price of the bond with the shorter term as the investors will collect the Select-3interest payments dChange the interest rate in a and b to 7 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar Price of the bond (eleven years to maturity): Price of the bond (five years to maturity):s Even though the interest rate is 7 percent in both calculations, why are the bond pricet different The price of the bond with the longer term s select than the price of the bond with the shorter term as the investors will collect the for a longer period of time se t nterest payments Check My Work (s remaining)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts