Question: Will need a spreadsheet to make a binomial tree. Show work and how you got there. Recall, a binomial option pays 1 if the stock

Will need a spreadsheet to make a binomial tree. Show work and how you got there.

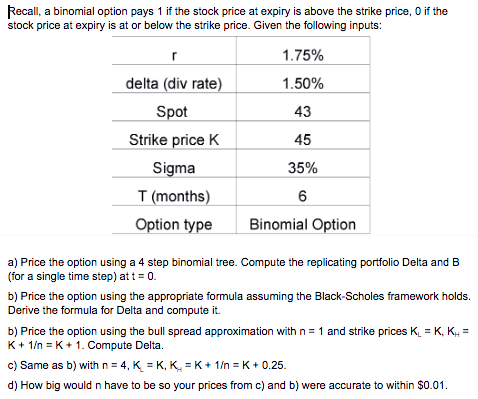

Recall, a binomial option pays 1 if the stock price at expiry is above the strike price, O if the stock price at expiry is at or below the strike price. Given the following inputs: 1.75% 1.50% delta (div rate) Spot Strike price K 43 45 Sigma 35% T (months) Option type Binomial Option a) Price the option using a 4 step binomial tree. Compute the replicating portfolio Delta and B (for a single time step) att = 0. b) Price the option using the appropriate formula assuming the Black-Scholes framework holds Derive the formula for Delta and compute it. b) Price the option using the bull spread approximation with n = 1 and strike prices K = KK - K + 1 = K+1. Compute Delta. c) Same as b) with n = 4, K = KK EK+ 1 = K +0.25. d) How big would n have to be so your prices from c) and b) were accurate to within $0.01. Recall, a binomial option pays 1 if the stock price at expiry is above the strike price, O if the stock price at expiry is at or below the strike price. Given the following inputs: 1.75% 1.50% delta (div rate) Spot Strike price K 43 45 Sigma 35% T (months) Option type Binomial Option a) Price the option using a 4 step binomial tree. Compute the replicating portfolio Delta and B (for a single time step) att = 0. b) Price the option using the appropriate formula assuming the Black-Scholes framework holds Derive the formula for Delta and compute it. b) Price the option using the bull spread approximation with n = 1 and strike prices K = KK - K + 1 = K+1. Compute Delta. c) Same as b) with n = 4, K = KK EK+ 1 = K +0.25. d) How big would n have to be so your prices from c) and b) were accurate to within $0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts