Question: Will only thumbs up if the full problem is correct Spartan Corporation, a U.S. corporation, reported $3.5 million of pretax income from its business operations

Will only thumbs up if the full problem is correct

Will only thumbs up if the full problem is correct

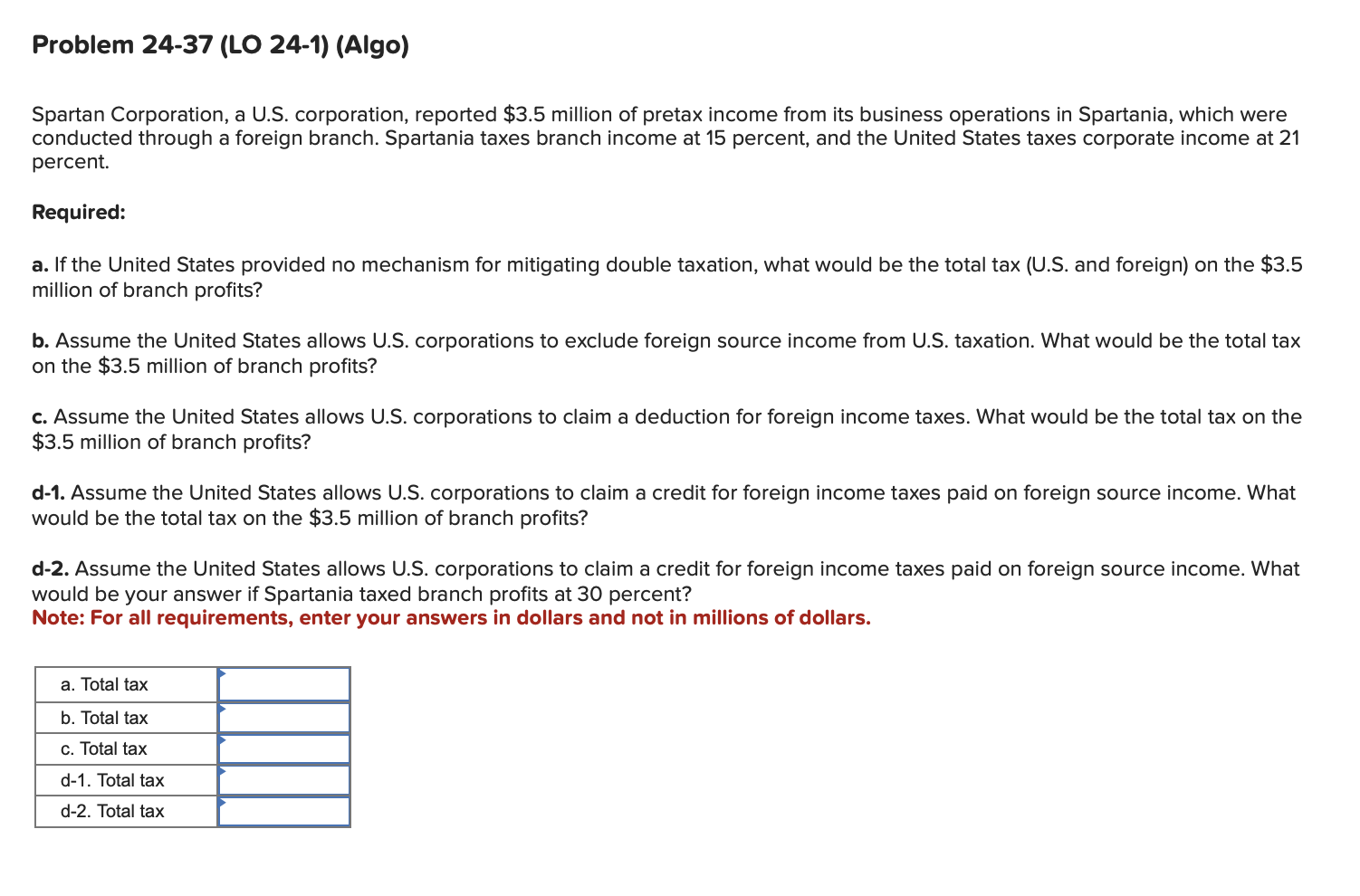

Spartan Corporation, a U.S. corporation, reported $3.5 million of pretax income from its business operations in Spartania, which were conducted through a foreign branch. Spartania taxes branch income at 15 percent, and the United States taxes corporate income at 21 percent. Required: a. If the United States provided no mechanism for mitigating double taxation, what would be the total tax (U.S. and foreign) on the $3.5 million of branch profits? b. Assume the United States allows U.S. corporations to exclude foreign source income from U.S. taxation. What would be the total tax on the $3.5 million of branch profits? c. Assume the United States allows U.S. corporations to claim a deduction for foreign income taxes. What would be the total tax on the \$3.5 million of branch profits? d-1. Assume the United States allows U.S. corporations to claim a credit for foreign income taxes paid on foreign source income. What would be the total tax on the $3.5 million of branch profits? d-2. Assume the United States allows U.S. corporations to claim a credit for foreign income taxes paid on foreign source income. What would be your answer if Spartania taxed branch profits at 30 percent? Note: For all requirements, enter your answers in dollars and not in millions of dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts