Question: WILL SEND A THUMBS UP IMMEDIATELY!! :)))) please answer with solutions. thank youuuu The following information is available for AVS-CVN Company: Credit sales during 2019

WILL SEND A THUMBS UP IMMEDIATELY!! :)))) please answer with solutions. thank youuuu

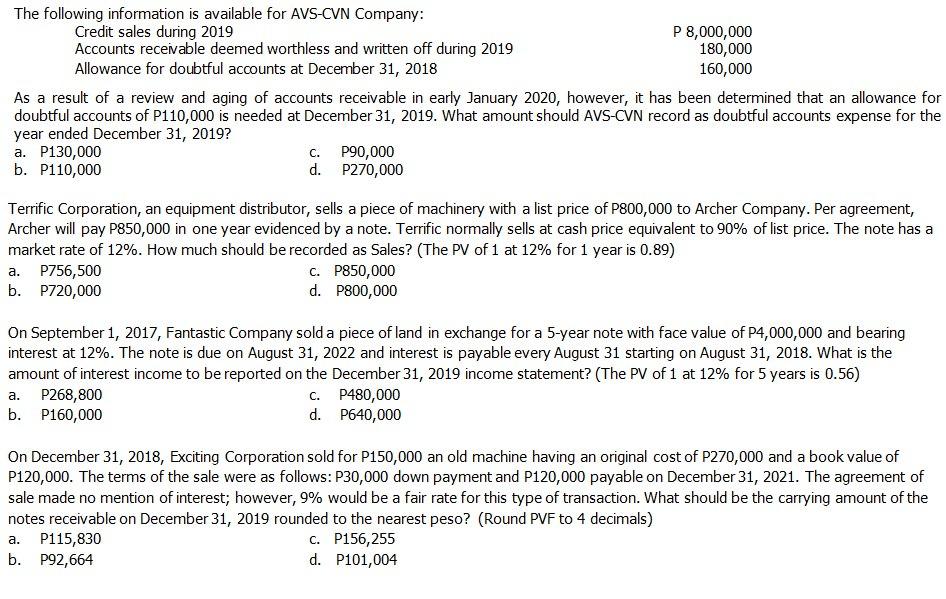

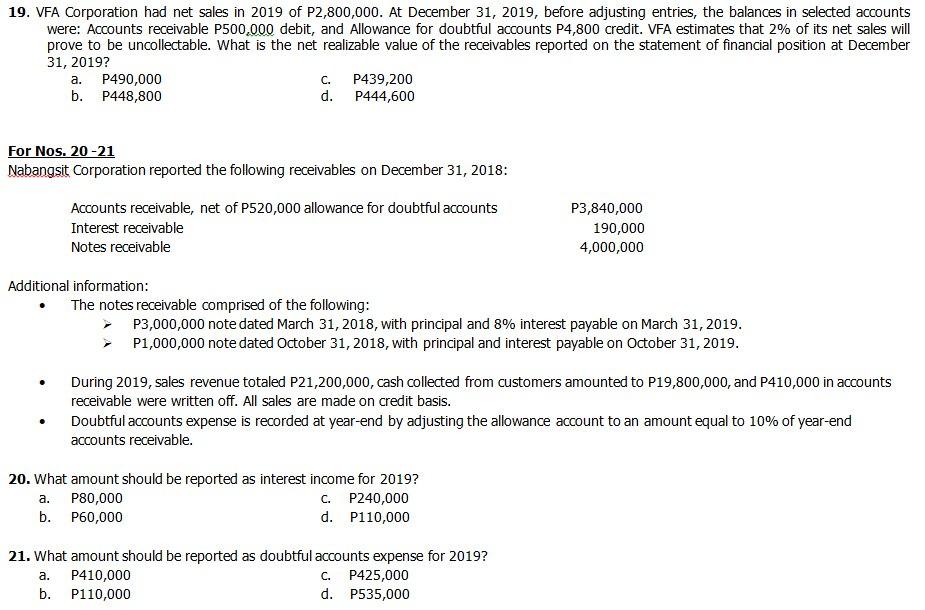

The following information is available for AVS-CVN Company: Credit sales during 2019 P 8,000,000 Accounts receivable deemed worthless and written off during 2019 180,000 Allowance for doubtful accounts at December 31, 2018 160,000 As a result of a review and aging of accounts receivable in early January 2020, however, it has been determined that an allowance for doubtful accounts of P110,000 is needed at December 31, 2019. What amount should AVS-CVN record as doubtful accounts expense for the year ended December 31, 2019? a. P130,000 P90,000 b. P110,000 d. P270,000 C. Terrific Corporation, an equipment distributor, sells a piece of machinery with a list price of P800,000 to Archer Company. Per agreement, Archer will pay P850,000 in one year evidenced by a note. Terrific normally sells at cash price equivalent to 90% of list price. The note has a market rate of 12%. How much should be recorded as Sales? (The PV of 1 at 12% for 1 year is 0.89) P756,500 C. P850,000 b. P720,000 d. P800,000 a. On September 1, 2017, Fantastic Company sold a piece of land in exchange for a 5-year note with face value of P4,000,000 and bearing interest at 12%. The note is due on August 31, 2022 and interest is payable every August 31 starting on August 31, 2018. What is the amount of interest income to be reported on the December 31, 2019 income statement? (The PV of 1 at 12% for 5 years is 0.56) a. P268,800 P480,000 b. P160,000 d. P640,000 On December 31, 2018, Exciting Corporation sold for P150,000 an old machine having an original cost of P270,000 and a book value of P120,000. The terms of the sale were as follows: P30,000 down payment and P120,000 payable on December 31, 2021. The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the carrying amount of the notes receivable on December 31, 2019 rounded to the nearest peso? (Round PVF to 4 decimals) a. P115,830 C. P156,255 b. P92,664 d. P101,004 19. VFA Corporation had net sales in 2019 of P2,800,000. At December 31, 2019, before adjusting entries, the balances in selected accounts were: Accounts receivable P500.000 debit, and Allowance for doubtful accounts P4,800 credit. VFA estimates that 2% of its net sales will prove to be uncollectable. What is the net realizable value of the receivables reported on the statement of financial position at December 31, 2019? P490,000 P439,200 b. P448,800 d. P444,600 a. C. For Nos. 20-21 Nabangsit Corporation reported the following receivables on December 31, 2018: Accounts receivable, net of P520,000 allowance for doubtful accounts Interest receivable Notes receivable P3,840,000 190,000 4,000,000 Additional information: The notes receivable comprised of the following: P3,000,000 note dated March 31, 2018, with principal and 8% interest payable on March 31, 2019. P1,000,000 note dated October 31, 2018, with principal and interest payable on October 31, 2019. During 2019, sales revenue totaled P21,200,000, cash collected from customers amounted to P19,800,000, and P410,000 in accounts receivable were written off. All sales are made on credit basis. Doubtful accounts expense is recorded at year-end by adjusting the allowance account to an amount equal to 10% of year-end accounts receivable. 20. What amount should be reported as interest income for 2019? P80,000 C. P240,000 b. P60,000 d. P110,000 a. 21. What amount should be reported as doubtful accounts expense for 2019? a. P410,000 C. P425,000 b. P110,000 d. P535,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts