Question: will someone help me on part (c) please? On January 1, 2026, Wildhorse Corp. had 461,000 shares of common stock outstanding. During 2026 , it

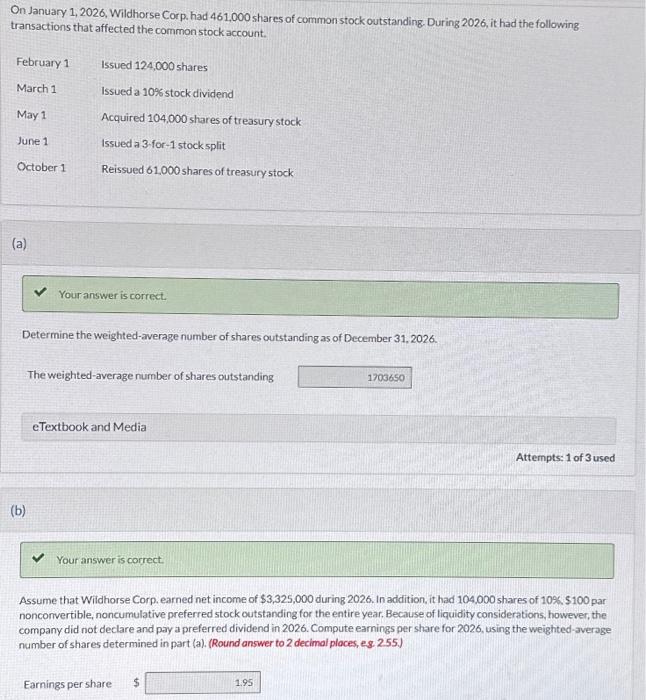

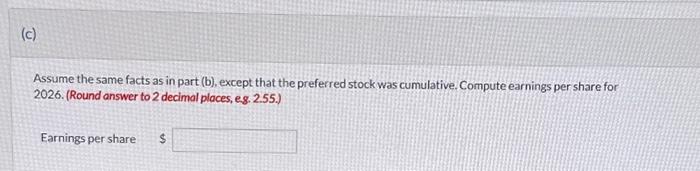

On January 1, 2026, Wildhorse Corp. had 461,000 shares of common stock outstanding. During 2026 , it had the following transactions that affected the common stock account. February 1 Issued 124,000 shares March 1 Issueda 10\% stock dividend May 1 Acquired 104,000 shares of treasury stock June 1 Issueda 3 for-1 stock split October 1 Reissued 61,000 shares of treasury stock (a) Your answer is correct. Determine the weighted-average number of shares outstanding as of December 31,2026. The weighted-average number of shares outstanding eTextbook and Media Attempts: 1 of 3 used (b) Assume that Wildhorse Corp, earned net income of $3,325,000 during 2026. In addition, it had 104,000 shares of 10%,$100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2026 . Compute earnings per share for 2026, using the weighted-averoge number of shares determined in part (a). (Round answer to 2 decimal places, es. 2.55.) Earnings per share Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earnings per share for 2026. (Round answer to 2 decimal places, e. 2.55.) Earnings per share $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts