Question: will thumbs up Not yet Question (4 Marks) CL03 You are trying to analyze interest offered on different bonds from different issuers to decide which

will thumbs up

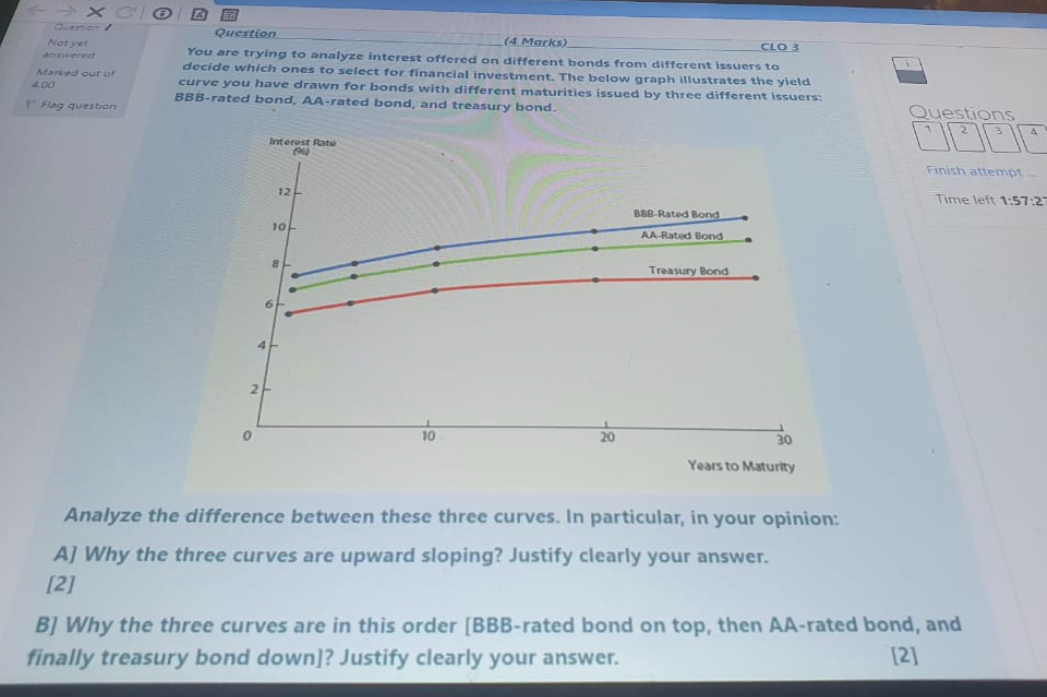

Not yet Question (4 Marks) CL03 You are trying to analyze interest offered on different bonds from different issuers to decide which ones to select for financial investment. The below graph illustrates the yield curve you have drawn for bonds with different maturities issued by three different issuers: BBB-rated bond, AA-rated bond, and treasury bond. Marked out of 400 Flag question Questions Interest Rate Finish attempt 12 Time left 1:57:21 BBR-Rated Bond 101 AA-Rated Bond 8 Treasury Bond 6 2 2 10 20 30 Years to Maturity Analyze the difference between these three curves. In particular, in your opinion: A] Why the three curves are upward sloping? Justify clearly your answer. [2] B] Why the three curves are in this order [BBB-rated bond on top, then AA-rated bond, and finally treasury bond down]? Justify clearly your answer. [2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts