Question: Will upvote answer QUESTION 1 PARTC AF Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements

Will upvote answer

Will upvote answer

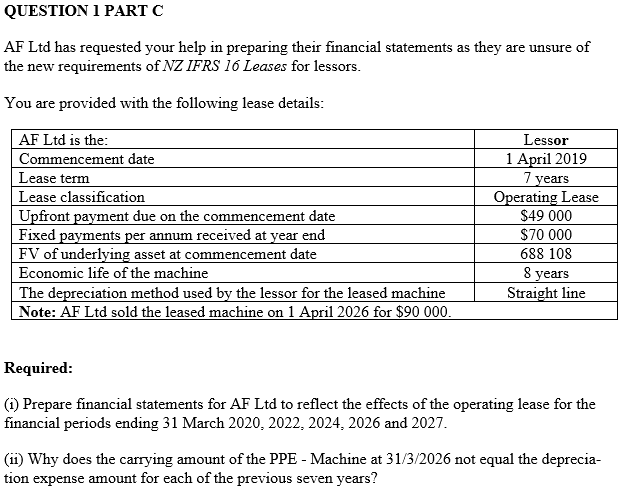

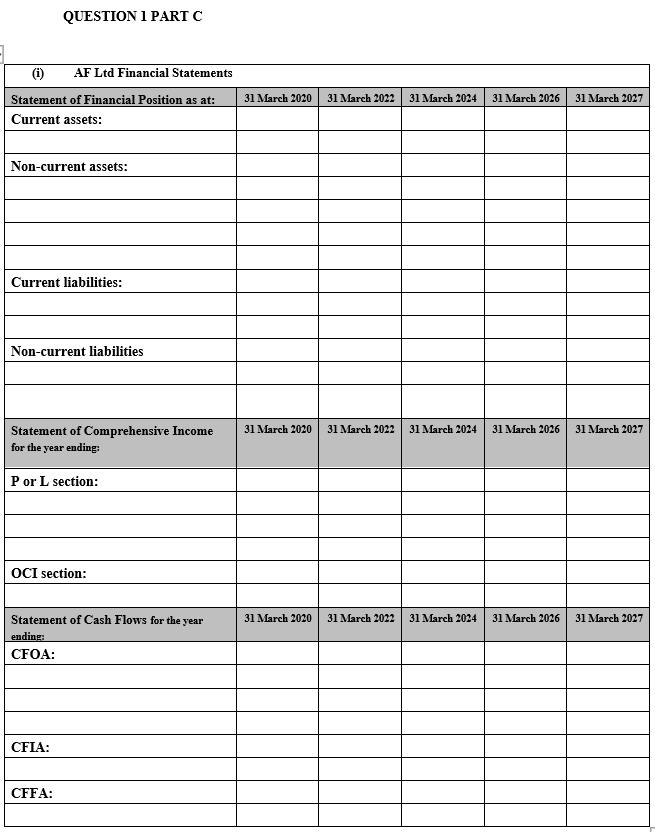

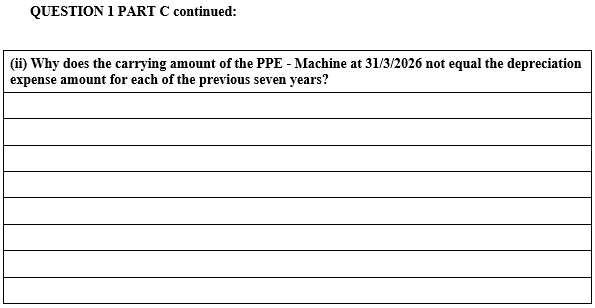

QUESTION 1 PARTC AF Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements of NZ IFRS 16 Leases for lessors. You are provided with the following lease details: Lessor 1 April 2019 7 years AF Ltd is the: Commencement date Lease term Lease classification Upfront payment due on the commencement date Fixed payments per annum received at year end FV of underlying asset at commencement date Economic life of the machine The depreciation method used by the lessor for the leased machine Note: AF Ltd sold the leased machine on 1 April 2026 for $90 000. Operating Lease $49 000 $70 000 688 108 8 years Straight line Required: (1) Prepare financial statements for AF Ltd to reflect the effects of the operating lease for the financial periods ending 31 March 2020, 2022 2024, 2026 and 2027. (11) Why does the carrying amount of the PPE - Machine at 31/3/2026 not equal the deprecia- tion expense amount for each of the previous seven years? QUESTION 1 PARTC (i) AF Ltd Financial Statements Statement of Financial Position as at: Current assets: 31 March 2020 31 March 2022 31 March 2014 31 March 2026 31 March 2027 Non-current assets: Current liabilities: Non-current liabilities 31 March 2020 31 March 2022 31 March 2024 31 March 2026 31 March 2027 Statement of Comprehensive Income for the year ending: Por L section: OCI section: 31 March 2020 31 March 2022 31 March 2024 31 March 2026 31 March 2027 Statement of Cash Flows for the year ending: CFOA: CFIA: CFFA: QUESTION 1 PART C continued: (ii) Why does the carrying amount of the PPE - Machine at 31/3/2026 not equal the depreciation expense amount for each of the previous seven years? QUESTION 1 PARTC AF Ltd has requested your help in preparing their financial statements as they are unsure of the new requirements of NZ IFRS 16 Leases for lessors. You are provided with the following lease details: Lessor 1 April 2019 7 years AF Ltd is the: Commencement date Lease term Lease classification Upfront payment due on the commencement date Fixed payments per annum received at year end FV of underlying asset at commencement date Economic life of the machine The depreciation method used by the lessor for the leased machine Note: AF Ltd sold the leased machine on 1 April 2026 for $90 000. Operating Lease $49 000 $70 000 688 108 8 years Straight line Required: (1) Prepare financial statements for AF Ltd to reflect the effects of the operating lease for the financial periods ending 31 March 2020, 2022 2024, 2026 and 2027. (11) Why does the carrying amount of the PPE - Machine at 31/3/2026 not equal the deprecia- tion expense amount for each of the previous seven years? QUESTION 1 PARTC (i) AF Ltd Financial Statements Statement of Financial Position as at: Current assets: 31 March 2020 31 March 2022 31 March 2014 31 March 2026 31 March 2027 Non-current assets: Current liabilities: Non-current liabilities 31 March 2020 31 March 2022 31 March 2024 31 March 2026 31 March 2027 Statement of Comprehensive Income for the year ending: Por L section: OCI section: 31 March 2020 31 March 2022 31 March 2024 31 March 2026 31 March 2027 Statement of Cash Flows for the year ending: CFOA: CFIA: CFFA: QUESTION 1 PART C continued: (ii) Why does the carrying amount of the PPE - Machine at 31/3/2026 not equal the depreciation expense amount for each of the previous seven years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts