Question: will upvote if correct. 1. (Markowitz fun) There are just three assets with rates of return ri, r2, and 13, respectively. The covariance matrix and

will upvote if correct.

will upvote if correct.

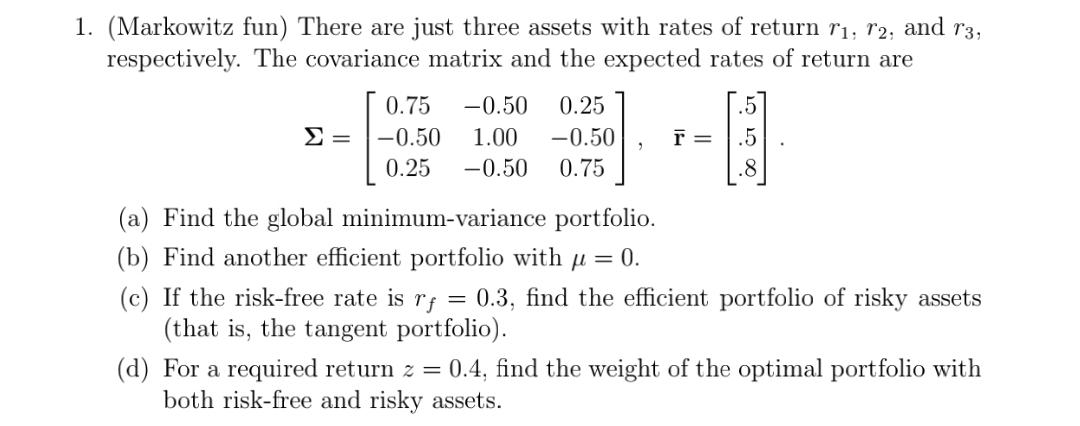

1. (Markowitz fun) There are just three assets with rates of return ri, r2, and 13, respectively. The covariance matrix and the expected rates of return are .5 = 0.75 -0.50 0.25 -0.50 1.00 -0.50 0.25 -0.50 0.75 r= .5 (a) Find the global minimum-variance portfolio. (b) Find another efficient portfolio with j = 0. (c) If the risk-free rate is rf = 0.3, find the efficient portfolio of risky assets (that is, the tangent portfolio). (d) For a required return z = 0.4, find the weight of the optimal portfolio with both risk-free and risky assets. 1. (Markowitz fun) There are just three assets with rates of return ri, r2, and 13, respectively. The covariance matrix and the expected rates of return are .5 = 0.75 -0.50 0.25 -0.50 1.00 -0.50 0.25 -0.50 0.75 r= .5 (a) Find the global minimum-variance portfolio. (b) Find another efficient portfolio with j = 0. (c) If the risk-free rate is rf = 0.3, find the efficient portfolio of risky assets (that is, the tangent portfolio). (d) For a required return z = 0.4, find the weight of the optimal portfolio with both risk-free and risky assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts