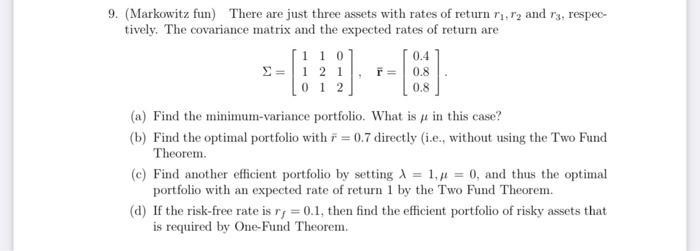

Question: 9. (Markowitz fun) There are just three assets with rates of return ri, r2 and 3, respec- tively. The covariance matrix and the expected

9. (Markowitz fun) There are just three assets with rates of return ri, r2 and 3, respec- tively. The covariance matrix and the expected rates of return are 110 = 1 2 1 012 0.4 f => 0.8 0.8 (a) Find the minimum-variance portfolio. What is in this case? (b) Find the optimal portfolio with F = 0.7 directly (i.e., without using the Two Fund Theorem. (c) Find another efficient portfolio by setting A = 1, 0, and thus the optimal portfolio with an expected rate of return 1 by the Two Fund Theorem. (d) If the risk-free rate is ry=0.1, then find the efficient portfolio of risky assets that is required by One-Fund Theorem.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts