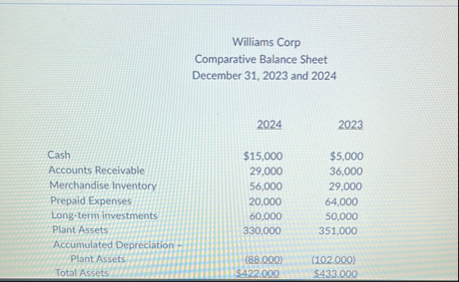

Question: Williams Corp Comparative Balance Sheet December 3 1 , 2 0 2 3 and 2 0 2 4 table [ [ , 2 0

Williams Corp

Comparative Balance Sheet

December and

tableCash$$Accounts Receivable,Merchandise Inventory,Prepaid Expenses,Longterminvestments,Plant Assets,Accumulated Depreciation Plant Assets,TotalAssets$$tableAccounts Payable,$$Accrued Liabilities,tableBonds PayableCommon StockRetained Earnings,Total Liabilities and,Stockholders Equity,$$

Additional information provided by the company includes the following:

Heldtomaturity securities carried at a cost of $ on December were sold in for $

Fully depreciated plant assets that cost $ were sold during for $During the company repaid $ of bonds payable by issuing common stock.

Dividends were paid in were $

Depreciation charged for the year was $

Instructions:

Prepare the statement of cash flows, using the indirect method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock