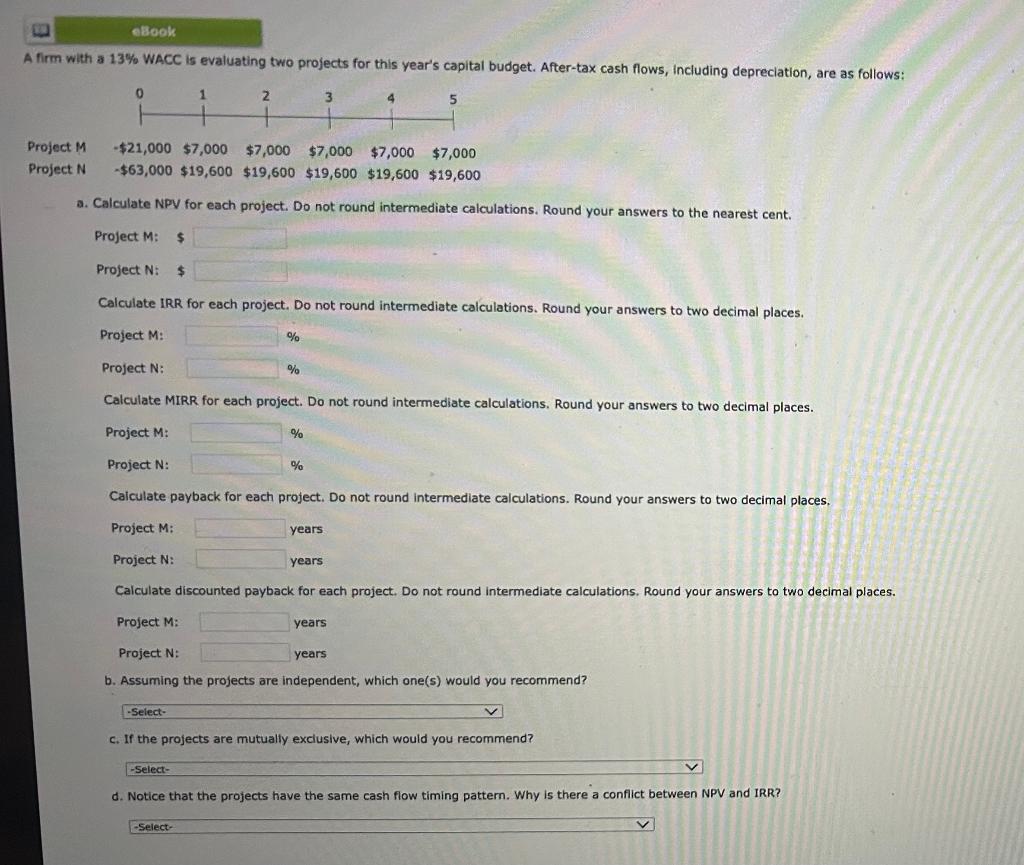

Question: with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, Including depreclation, are as follows: a. Calculate NPV for

with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, Including depreclation, are as follows: a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N:$ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N : % Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M : % Project N : % Caiculate payback for each project. Do not round intermedlate calculations. Round your answers to two decimal places. ProjectM:ProjectN:yearsyears Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M : years Project N : years b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? -Select- d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts