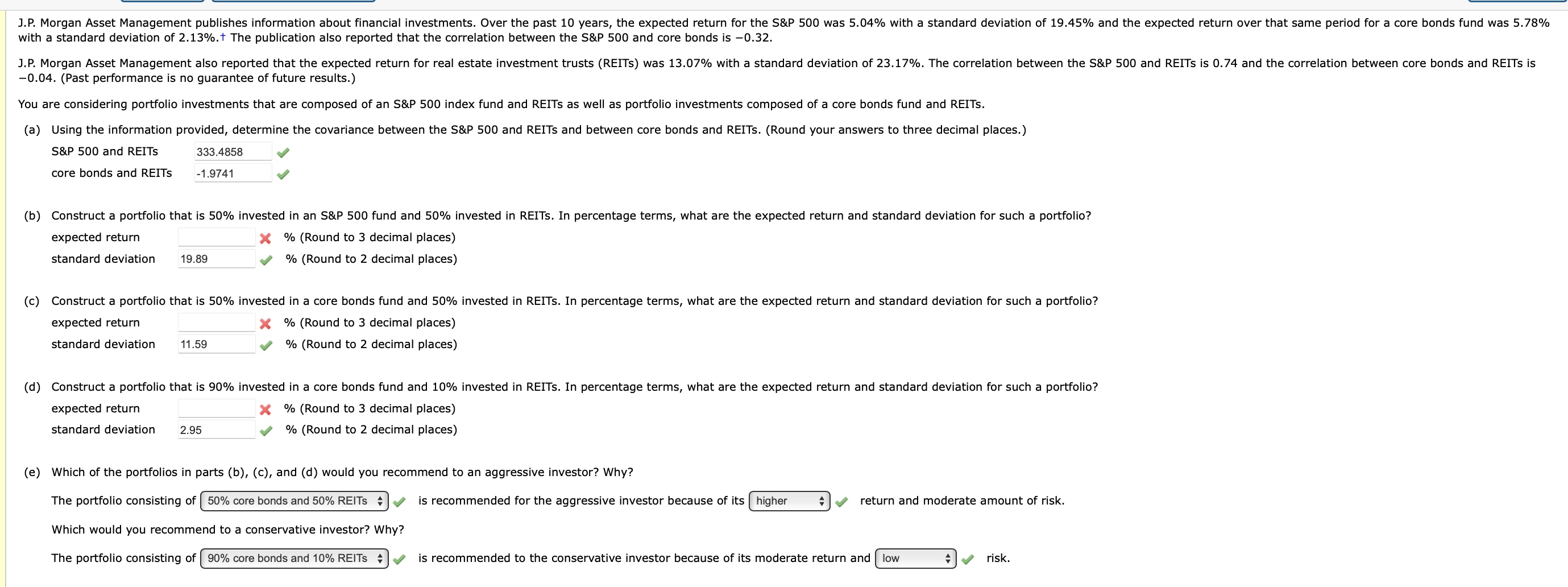

Question: with a standard deviation of 2 . 1 3 % . + The publication also reported that the correlation between the S&P 5 0 0

with a standard deviation of The publication also reported that the correlation between the S&P and core bonds is

Past performance is no guarantee of future results.

S&P and REITs

core bonds and REITs

expected return Round to decimal places

standard deviation Round to decimal places

expected return

times Round to decimal places

standard deviation Round to decimal places

expected return

Round to decimal places

standard deviation

Round to decimal places

e Which of the portfolios in parts bc and d would you recommend to an aggressive investor? Why?

Which would you recommend to a conservative investor? Why?

The portfolio consisting of

is recommended to the conservative investor because of its moderate return and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock