Question: With each response, can you include the positive & negative consqeuences in reference to what GAAP or the company would suggest. Ethics Case 7-11 Uncollectible

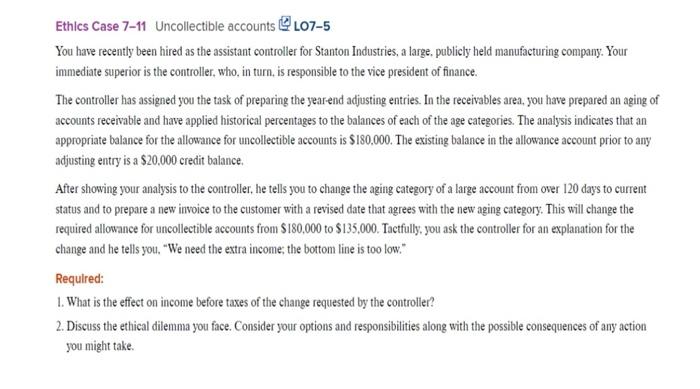

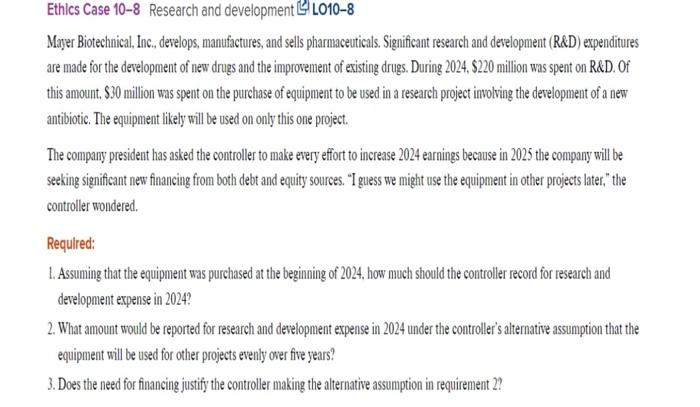

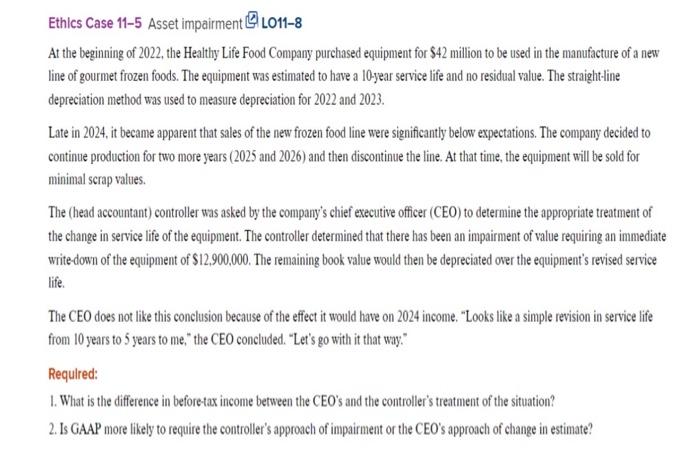

Ethics Case 7-11 Uncollectible accounts LO7-5 You have recently been hired as the assistant controller for Stanton Industries, a large, publicly held manufacturing company. Your immediate superior is the controller, who, in turn, is responsible to the vice president of finance. The controller has assigned you the task of preparing the jear-end adjusting entries. In the receivables area, you have prepared an aging of accounts receivable and have applied historical percentages to the balances of ench of the age categories. The analysis indicates that an appropriate balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new aging category. This will change the required allowance for uncollectible accounts from $180,000 to $135,000. Tactfully, you ask the controller for an explanation for the change and he tells you, "We need the extra income; the bottom line is too low." Requlred: 1. What is the effect on income before taxes of the change requested by the controller? 2. Discuss the ethical dilemma you face. Consider your options and responsibilities along with the possible consequences of any action you might take. Mager Biotechnical, Inc., develops, manufactures, and sells pharmaceuticals. Significant research and development (R\&D) expenditures are made for the development of new drugs and the improvement of existing drugs. During 2024,\$220 million was spent on R\&D. Of this amount. $30 million was spent on the purchase of equipment to be used in a research project involving the derelopment of a new antibiotic. The equipment likely will be used on only this one project. The company president has asked the controller to make every effort to increase 2024 earnings because in 2025 the company will be seeking significant new financing from both debt and equity sources. "I guess we might use the equipment in other projects later," the controller wondered. Required: 1. Assuming that the equipment was purchased at the beginning of 2024, how much should the controller record for research and development expense in 2024 ? 2. What amount would be reported for research and development expense in 2024 under the controller's alternative assumption that the equipment will be used for other projects evenly over five years? 3. Does the need for financing justify the controller making the alternative assumption in requirement 2 ? Ethlcs Case 11-5 Asset impairment 5 L L011-8 At the beginning of 2022, the Healthy Life Food Company purchased equipment for $42 million to be used in the manufacture of a new line of gourmet frozen foods. The equipment was estimated to have a 10-year service life and no residual value. The straight-line depreciation method was used to measure depreciation for 2022 and 2023. Late in 2024, it became apparent that sales of the new frozen food line were significantly below expectations. The company decided to continue production for two more years (2025 and 2026) and then discontinue the line. At that time, the equipment will be sold for minimal scrap values. The (head accountant) controller was asked by the company's chief executive officer (CEO) to determine the appropriate treatment of the change in service life of the equipment. The controller determined that there has been an impairment of value requiring an immediate write-down of the equipment of $12,900,000. The remaining book value would then be depreciated over the equipment's revised service life. The CEO does not like this conclusion because of the effect it would have on 2024 income. "Looks like a simple revision in service life from 10 years to 5 years to me," the CEO concluded. "Let's go with it that way." Requlred: 1. What is the difference in before-tax income between the CEO's and the controller's treatment of the situation? 2. Is GAAP more likely to require the controller's approach of impairment or the CEO's approach of change in estimate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts