Question: With regards to Net Basis/Gross Basis and Clearing Margin by Futures Exchange Clearinghouse members, which of the following statements are FALSE? 1. There are two

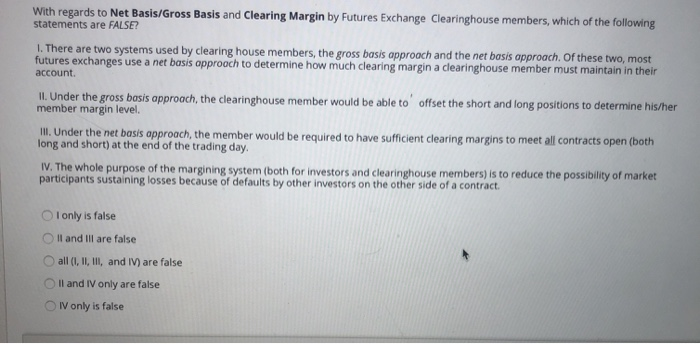

With regards to Net Basis/Gross Basis and Clearing Margin by Futures Exchange Clearinghouse members, which of the following statements are FALSE? 1. There are two systems used by clearing house members, the gross basis approach and the net basis approach of these two, most futures exchanges use a net basis opprooch to determine how much clearing margin a clearinghouse member must maintain in their account. II. Under the gross basis approach, the clearinghouse member would be able to offset the short and long positions to determine his/her member margin level. Ill. Under the net basis approach, the member would be required to have sufficient clearing margins to meet all contracts open (both long and short) at the end of the trading day. IV. The whole purpose of the margining system (both for investors and clearinghouse members) is to reduce the possibility of market participants sustaining losses because of defaults by other investors on the other side of a contract I only is false Oil and III are false all (I, II, II, and IV) are false II and IV only are false O IV only is false

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts