Question: with solution 47. NRA Mining is engaged in the exploration of minerals and started operation January 1, 2020 and cum the following expenditure: Amount Acquisition

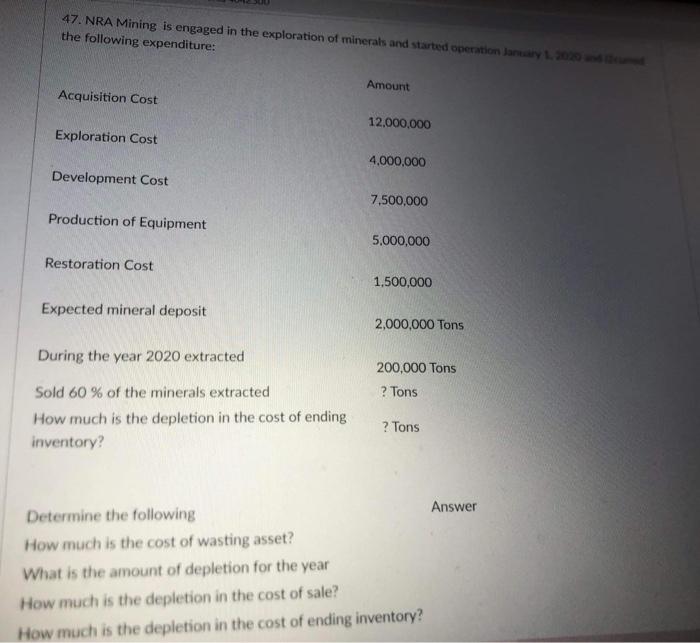

47. NRA Mining is engaged in the exploration of minerals and started operation January 1, 2020 and cum the following expenditure: Amount Acquisition Cost 12,000,000 Exploration Cost 4,000,000 Development Cost 7,500,000 Production of Equipment 5,000,000 Restoration Cost 1,500,000 Expected mineral deposit 2,000,000 Tons During the year 2020 extracted 200,000 Tons Sold 60% of the minerals extracted ? Tons ? Tons How much is the depletion in the cost of ending inventory? Determine the following How much is the cost of wasting asset? What is the amount of depletion for the year How much is the depletion in the cost of sale? How much is the depletion in the cost of ending inventory? Answer 47. NRA Mining is engaged in the exploration of minerals and started operation January 1, 2020 and cum the following expenditure: Amount Acquisition Cost 12,000,000 Exploration Cost 4,000,000 Development Cost 7,500,000 Production of Equipment 5,000,000 Restoration Cost 1,500,000 Expected mineral deposit 2,000,000 Tons During the year 2020 extracted 200,000 Tons Sold 60% of the minerals extracted ? Tons ? Tons How much is the depletion in the cost of ending inventory? Determine the following How much is the cost of wasting asset? What is the amount of depletion for the year How much is the depletion in the cost of sale? How much is the depletion in the cost of ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts