Question: With the financial objectives and assumptions presented below, prepare the following for the company: e) The companys 2014 sustainable growth rate Financial objectives and assumptions:

With the financial objectives and assumptions presented below, prepare the following for the company: e) The companys 2014 sustainable growth rate

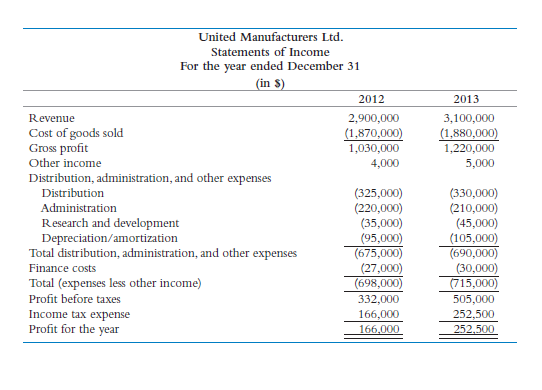

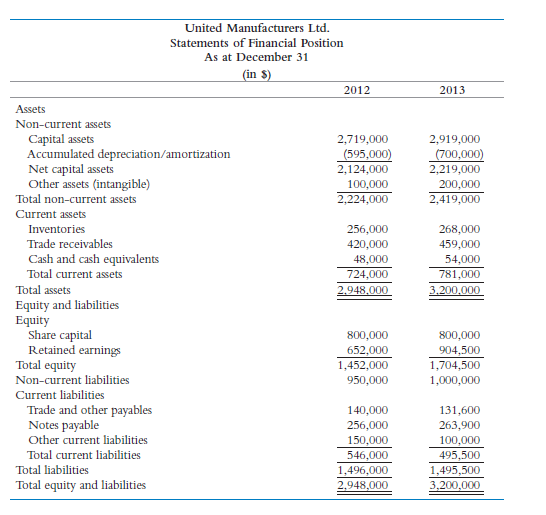

Financial objectives and assumptions: 1. Related to the statement of income: Revenue will increase by 10.0%. Cost of sales as a percentage of revenue will decline to 51.5%. Distribution costs as a percentage of revenue will improve slightly to 10.5%. General and administrative expenses will drop to 5.7% of revenue. Research and development costs as a percentage of revenue will increase to 2.0%. Depreciation/amortization will be $120,000. Other income will be $6,000. Finance costs will be $35,000. Income tax rate (as a percent of profit before taxes) will be maintained at the 2013 level. 2. Related to the statement of changes in equity: $50,000 in dividends will be paid to shareholders. 3. Related to the statement of financial position: a. Non-current asset accounts Investment in new capital assets will be $660,000. Other assets will be increased by $100,000. b. Current asset accounts Inventories will improve to 4.9 times. Trade receivables will improve to 44.9 days. Cash and cash equivalents will be 2.0% of revenue. c. Equity Shareholders will invest an additional $200,000 in the business. d. Non-current liabilities Long-term borrowings will increase by $39,700. e. Current liabilities Trade and other payables will increase to 11.31% of cost of sales.

Notes payable will increase to $268,685.

United Manufacturers Ltd. Statements of Income For the year ended December 31 (in \$) United Manufacturers Ltd. Statements of Financial Position As at December 31 (in \$) Assets Non-current assets United Manufacturers Ltd. Statements of Income For the year ended December 31 (in \$) United Manufacturers Ltd. Statements of Financial Position As at December 31 (in \$) Assets Non-current assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts