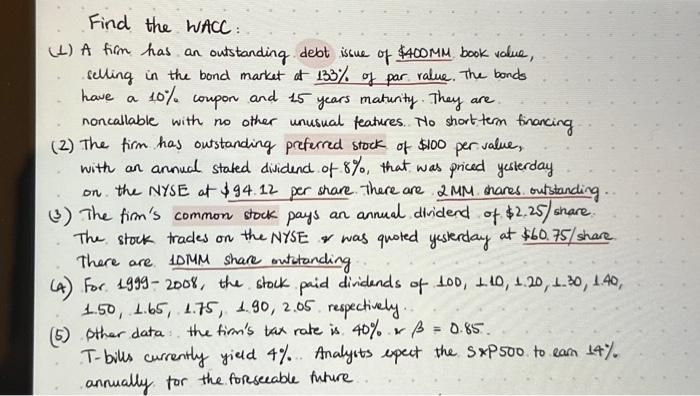

Question: With the given information, find the WACC. Please show answer with detail explanations step by step. Thanks! (1) A firm has an outstanding debt issue

(1) A firm has an outstanding debt issue of $400MM book value, selling in the bond market ot 133% of par ralue. The bonds have a 10% coupon and 15 years maturity. They are noncallable with no other unusual features. No shortterm financing (2) The firm has outstanding preterred stock of $100 per value, with an annual stated dividend of 8%, that was priced yesterday on the NYSE at $94.12 per share. There are 2MM. mares outstanding (3) The fim's common stock pays an anmual dividend of $2,25/ share. The stock trades on the NYSE was quoted yesterday at $60.75/ share. There are 10MM share oututanding (4) For 1999-2008, the stock paid dividends of 100,110,1.20,1.30,1.40, 1.50,1.65,1.75,1.90,2.05 respectively. (5) Dther data: the firm's tax rate is 40%=0.85. T-bills currently yield 4%. Analyits upect the 5P500 to eam 14% annually for the forsecable future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts