Question: With the help of the Excel spread sheet provided, compute the market debt to equity (D/E) ratio for BOX. Then use it to find the

With the help of the Excel spread sheet provided, compute the market debt to equity (D/E) ratio for BOX. Then use it to find the current cost of equity (rE) and the pretaxWACC for BOX. Assuming the cost of unlevered equity (rU) is 12%.

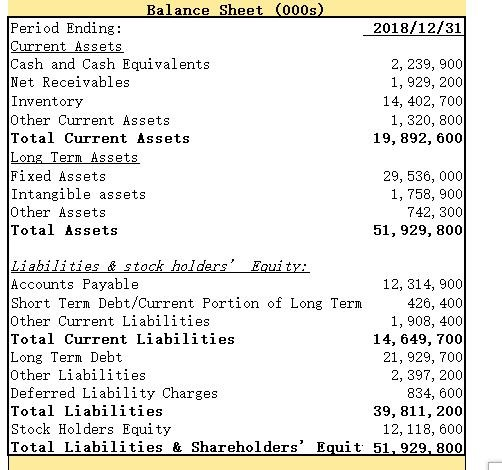

Balance Sheet (000s) Period Ending Current Assets Cash and Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Long Term Assets Fixed Assets Intangible assets Other Assets Total Assets 2018/12/31 2, 239, 900 1, 929, 200 14, 402, 700 1, 320, 800 19, 892, 600 29, 536, 000 1, 758, 900 742, 300 51, 929, 800 Liabilities & stock holders' Eouity: Accounts Payable Short Term Debt/Current Portion of Long Term Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Deferred Liability Charges Total Liabilities Stock Holders Equity Total Liabilities & Shareholders' Equit 51, 929, 800 12, 314, 900 426, 400 1, 908, 400 14, 649, 700 21, 929, 700 2, 397, 200 834, 600 39, 811, 200 12, 118, 600 Balance Sheet (000s) Period Ending Current Assets Cash and Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Long Term Assets Fixed Assets Intangible assets Other Assets Total Assets 2018/12/31 2, 239, 900 1, 929, 200 14, 402, 700 1, 320, 800 19, 892, 600 29, 536, 000 1, 758, 900 742, 300 51, 929, 800 Liabilities & stock holders' Eouity: Accounts Payable Short Term Debt/Current Portion of Long Term Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Deferred Liability Charges Total Liabilities Stock Holders Equity Total Liabilities & Shareholders' Equit 51, 929, 800 12, 314, 900 426, 400 1, 908, 400 14, 649, 700 21, 929, 700 2, 397, 200 834, 600 39, 811, 200 12, 118, 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts