Question: With the solutions to #1-4, I need help solving #5-8. Please help fast! Thank you! Your firm is considering an investment in a new production

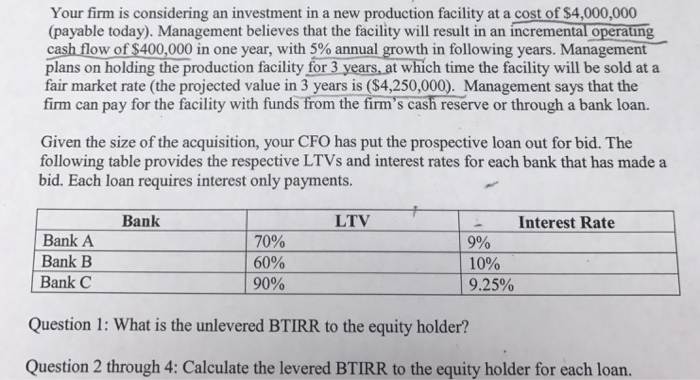

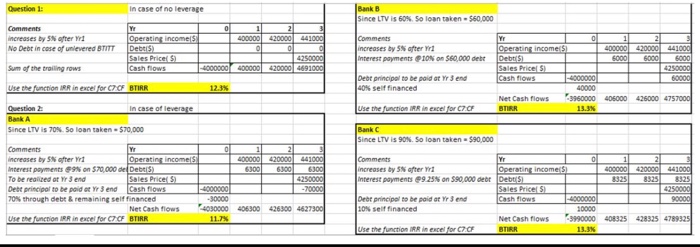

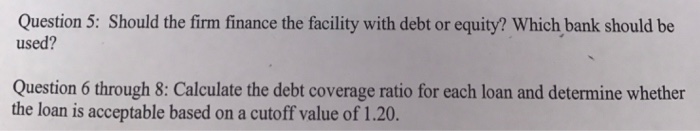

Your firm is considering an investment in a new production facility at a cost of $4,000,000 (payable today). Management believes that the facility will result in an incremental operatng cash low of 400,000 in one year, with 5% annual growth in following years. Management plans on holding the production facility for 3 years, at which time the facility will be sold at a fair market rate (the projected value in 3 years is ($4,250,000). Management says that the firm can pay for the facility with funds from the firm's cash reserve or through a bank loan. Given the size of the acquisition, your CFO has put the prospective loan out for bid. The following table provides the respective LTVs and interest rates for each bank that has made a bid. Each loan requires interest only payments. Bank LTV Interest Rate Bank A Bank B Bank C 70% 60% 90% 9% 10% 9.25% Question 1: What is the unlevered BTIRR to the equity holder? Question 2 through 4: Calculate the levered BTIRR to the equity holder for each loan. Your firm is considering an investment in a new production facility at a cost of $4,000,000 (payable today). Management believes that the facility will result in an incremental operatng cash low of 400,000 in one year, with 5% annual growth in following years. Management plans on holding the production facility for 3 years, at which time the facility will be sold at a fair market rate (the projected value in 3 years is ($4,250,000). Management says that the firm can pay for the facility with funds from the firm's cash reserve or through a bank loan. Given the size of the acquisition, your CFO has put the prospective loan out for bid. The following table provides the respective LTVs and interest rates for each bank that has made a bid. Each loan requires interest only payments. Bank LTV Interest Rate Bank A Bank B Bank C 70% 60% 90% 9% 10% 9.25% Question 1: What is the unlevered BTIRR to the equity holder? Question 2 through 4: Calculate the levered BTIRR to the equity holder for each loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts