Question: Without using excel 4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform the same repetitive task. The two alternatives available

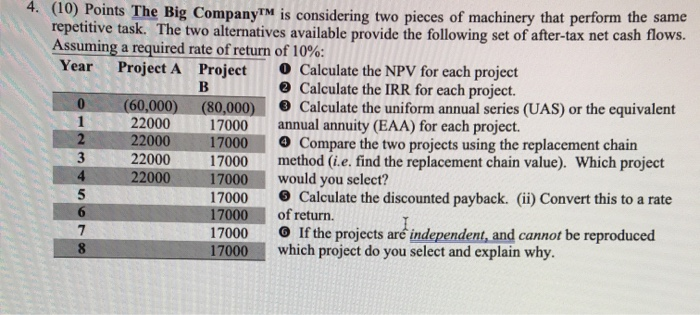

4. (10) Points The Big CompanyTM is considering two pieces of machinery that perform the same repetitive task. The two alternatives available provide the following set of after-tax net cash flows. Assuming a required rate of return of 10%: Year Project A Project O Calculate the NPV for each project B Calculate the IRR for each project. 0 (60,000) (80,000) Calculate the uniform annual series (UAS) or the equivalent 1 22000 17000 annual annuity (EAA) for each project. 2 22000 17000 Compare the two projects using the replacement chain 3 22000 17000 method (i.e. find the replacement chain value). Which project 4 22000 17000 would you select? 5 17000 Calculate the discounted payback. (ii) Convert this to a rate 6 17000 of return. 7 17000 If the projects are independent, and cannot be reproduced 17000 which project do you select and explain why. 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts