Question: Witwer Inc. is making plans for next year. It expects sales to be $300,000, operating costs to be $280,000, assets to be $220,000, and its

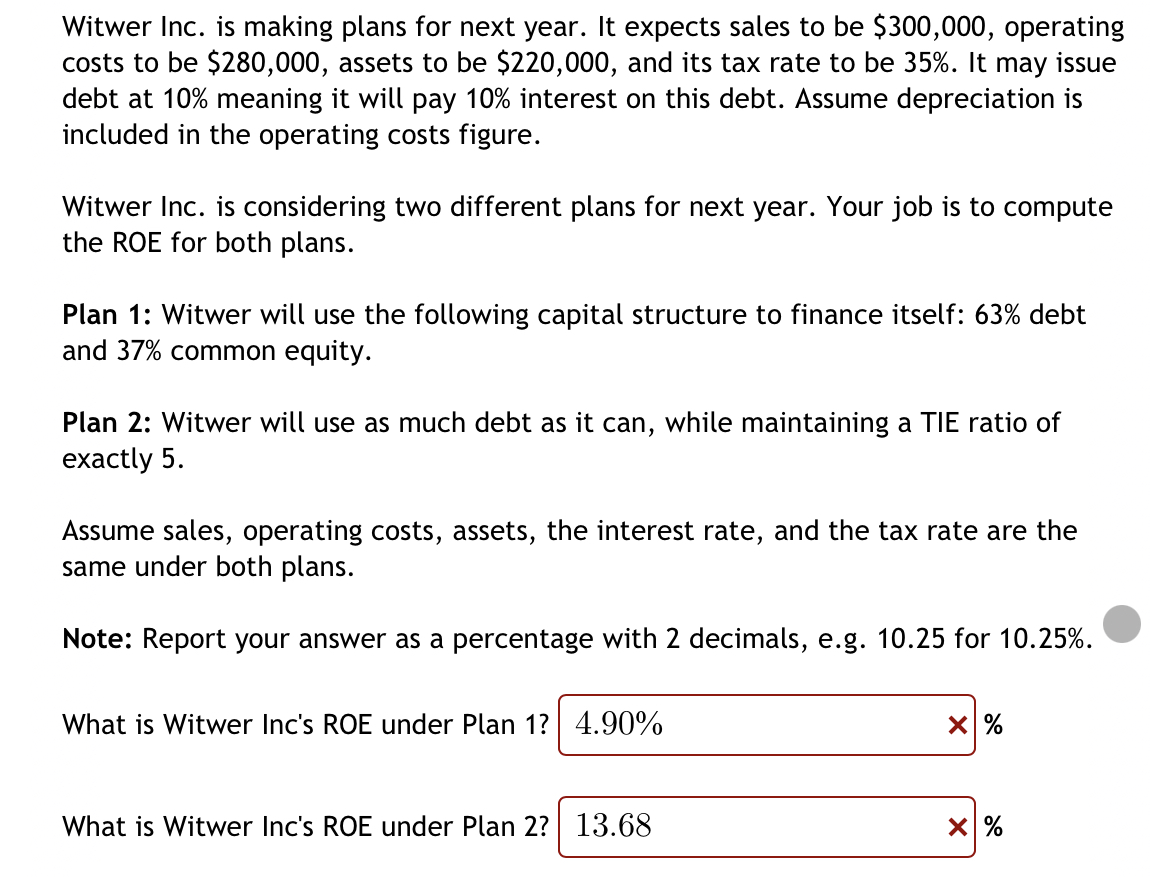

Witwer Inc. is making plans for next year. It expects sales to be $300,000, operating costs to be $280,000, assets to be $220,000, and its tax rate to be 35%. It may issue debt at 10% meaning it will pay 10% interest on this debt. Assume depreciation is included in the operating costs figure. Witwer Inc. is considering two different plans for next year. Your job is to compute the ROE for both plans. Plan 1: Witwer will use the following capital structure to finance itself: 63% debt and 37% common equity. Plan 2: Witwer will use as much debt as it can, while maintaining a TIE ratio of exactly 5 . Assume sales, operating costs, assets, the interest rate, and the tax rate are the same under both plans. Note: Report your answer as a percentage with 2 decimals, e.g. 10.25 for 10.25%. What is Witwer Inc's ROE under Plan 1? % What is Witwer Inc's ROE under Plan 2? %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts