Question: Witwer Inc. is making plans for next year. It expects sales to be $ 3 4 0 , 0 0 0 , operating costs to

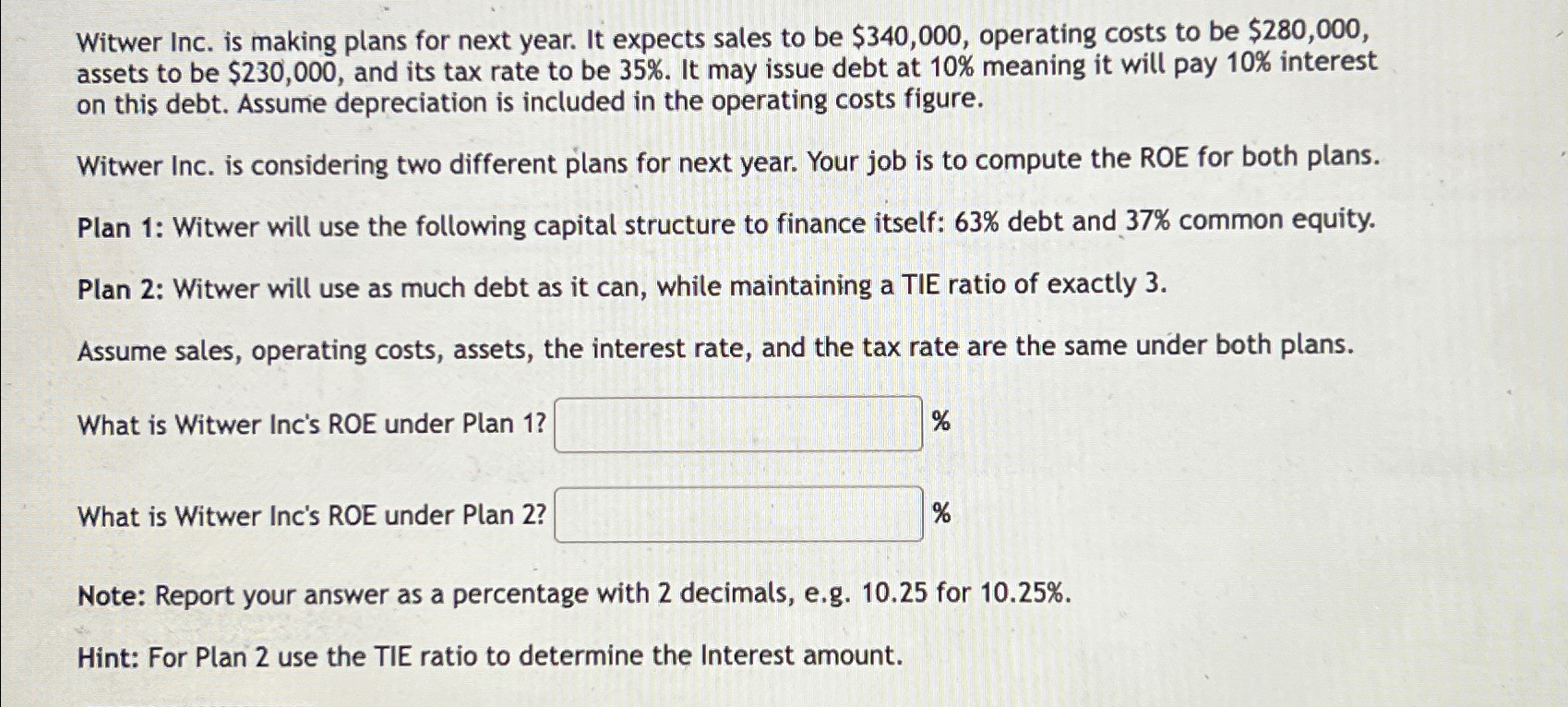

Witwer Inc. is making plans for next year. It expects sales to be $ operating costs to be $ assets to be $ and its tax rate to be It may issue debt at meaning it will pay interest on this debt. Assume depreciation is included in the operating costs figure.

Witwer Inc. is considering two different plans for next year. Your job is to compute the ROE for both plans.

Plan : Witwer will use the following capital structure to finance itself: debt and common equity.

Plan : Witwer will use as much debt as it can, while maintaining a TIE ratio of exactly

Assume sales, operating costs, assets, the interest rate, and the tax rate are the same under both plans.

What is Witwer Inc's ROE under Plan

What is Witwer Inc's ROE under Plan

Note: Report your answer as a percentage with decimals, eg for

Hint: For Plan use the TIE ratio to determine the Interest amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock